The US was running budget surpluses in the late forties and through much of the fifties. Americans were young, and there were far more workers producing than collecting government Social Security welfare checks.

Those days are gone, and although American workers continue to be highly productive, the burden each worker must bear to pay for the elderly and the unproductive continues to grow.

What we have now is a country heavily dependent on ever-larger amounts of government spending and monetary expansion.

https://mises.org/wire/covid-stimulus-isnt-other-stimulus-its-much-bigger

When it comes to policy debates, it’s now pretty clear that if you’d like to sound very quaint and old fashioned, be sure to express some concerns over the size of the federal budget and deficit spending.

Such concerns are now taken about as seriously by the average politician in Washington as is the constitutionality of the PATRIOT Act. Virtually no one cares.

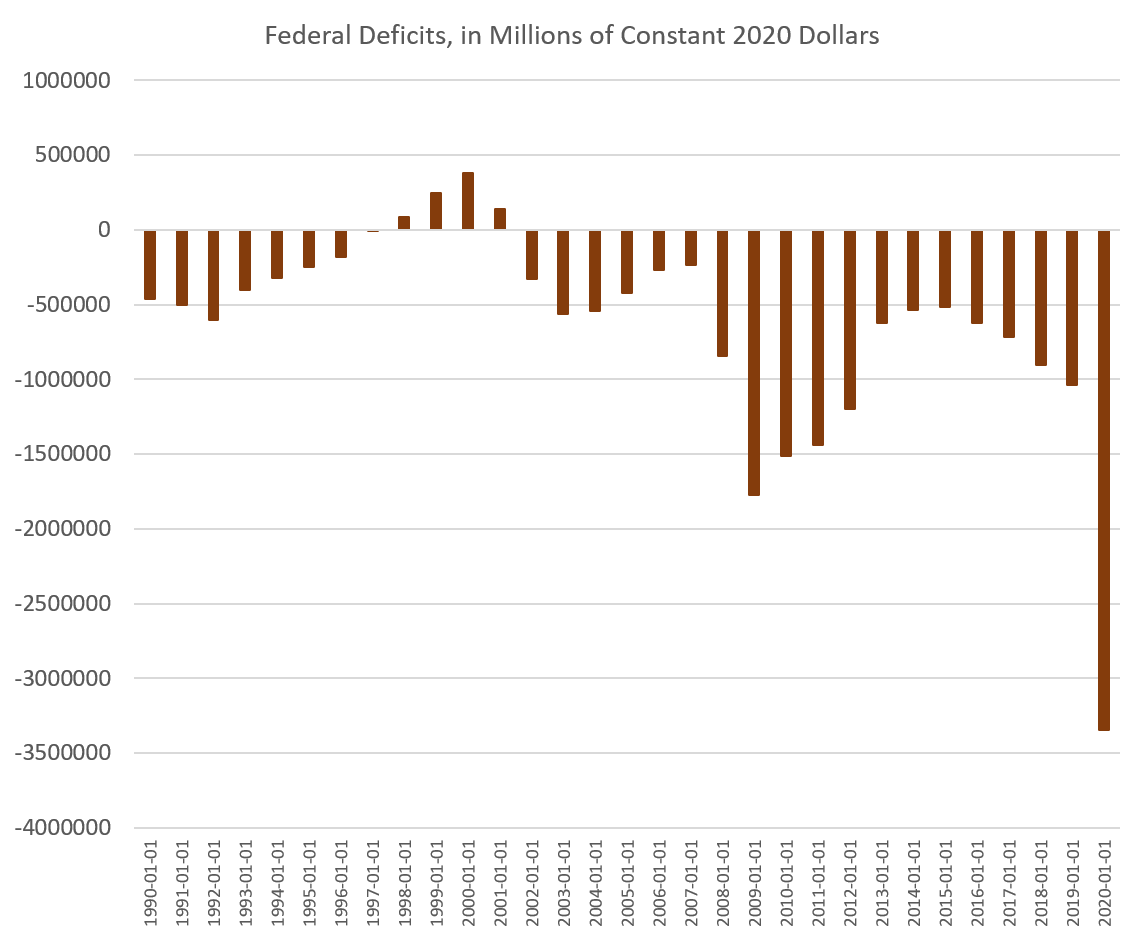

Admittedly, the lack of interest in spending was already largely in place before the covid crisis began. During the Trump administration, reckless federal spending was the norm, and inflation-adjusted federal spending surged even past spending in 2009, when the federal government was panicking over the financial crisis and the Great Recession. In other words, the Trump administration gave us crisis-level spending when there wasn’t even a crisis.

Not surprisingly, deficit spending was also remarkably high under Trump—precovid—as well. By 2019, Trump had signed off on a trillion-dollar deficit, something many thought to be outlandish during a nonrecessionary period before that.

But those numbers—including the numbers from the Great Recession bailout years—all look modest compared to the surge in spending that occurred with the covid panic of 2020 and 2021.

Let’s compare spending in the two periods. For example, from 2019 to 2020, federal spending rose 54 percent—from $4.5 trillion to $6.5 trillion, respectively—as Congress and the White House poured money into bailouts and stimulus. On the other hand, in the wake of the financial crisis, from 2008 to 2009, spending “only” increased 14 percent, from $3.6 trillion to $4.2 trillion.

On a per capita basis, the numbers were similar. Per capital federal spending rose 13 percent from 2008 to 2009, rising from $12,000 to $13,700 for each American. But from 2019 to 2020, per capita spending rose 44 percent, from $13,600 to $19,700. (These numbers are all in constant 2020 dollars.)

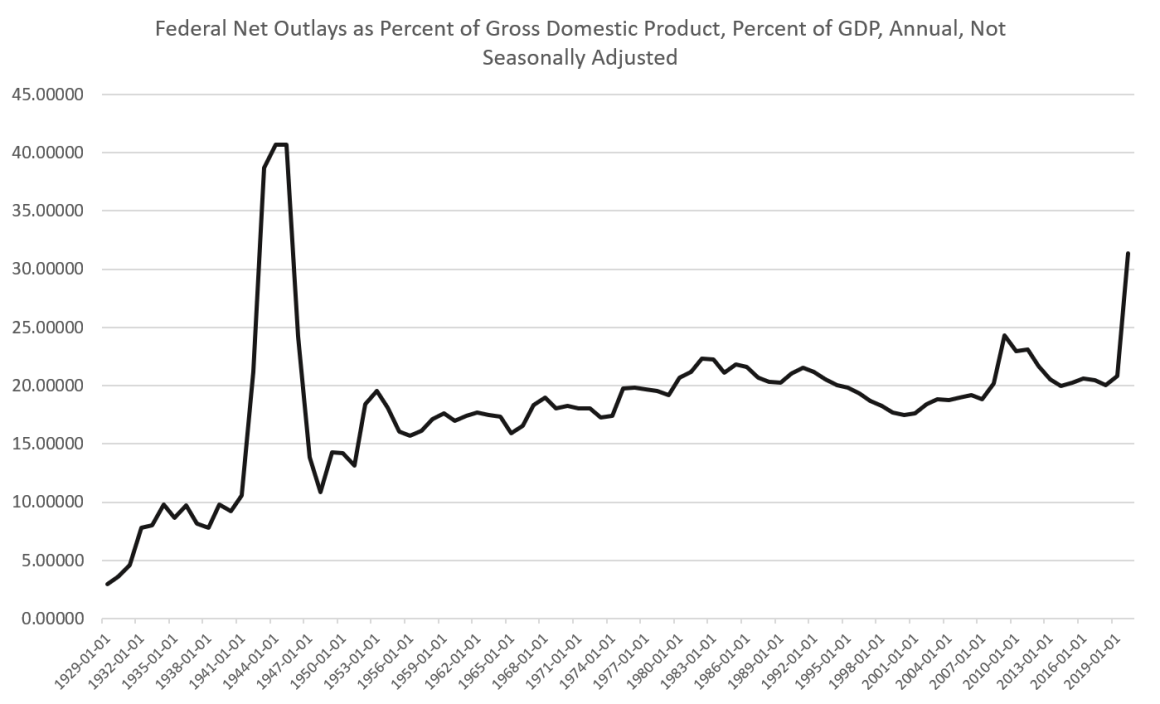

Spending Levels Similar to World War II

At this point, defenders of runaway spending will often suggest that what really matters is spending compared to gross domestic product (GDP).

So let’s look at that measure. In 2020, federal outlays as a percentage of the nation’s GDP surged to 31 percent, the highest number seen since 1945.

Similarly, the federal deficit as a percentage of GDP surged to nearly 15 percent in 2020. Again, this is the highest number seen of this measure since 1945.

(Proportional comparisons of this sort tend to understate the extent to which debt and spending is growing compared to the overall GDP. This is because government spending is itself a component of GDP, and since GDP is measured in dollars, monetary expansion—even without true growth in economic activity—can fuel GDP expansion as well.)

Also of political significance is the fact that while federal spending was taking off over the past eighteen months, growth in state and local spending nearly flatlined, dropping to 0.38 percent growth over the previous year. That’s the lowest growth rate in state and local spending since 2011, in the wake of the 2008 financial crisis. Yet, at the same time, federal spending increased by 25 percent—the largest year-over-year increase in federal spending since the Korean War.

All combined, this means federal spending surged to comprise more than two-thirds of all government spending in the US during 2020. We’d have to go back to the dark days of the Cold War and the Vietnam War to find the last time federal spending so dominated government spending in America.

This all reflects the fact that state and local governments are actually affected by economic crises. That is, when incomes and economic activity fall, state and local revenues—and spending—fall. Not so with the federal government, which, thanks to the central bank’s willingness to buy up US debt, can much more easily engage in large amounts of deficit spending than can state and local governments.

Author:

Ryan McMaken is a senior editor at the Mises Institute. Send him your article submissions for the Mises Wire and Power&Market, but read article guidelines first.

Be seeing you

by Tyler DurdenSunday, Mar 14, 2021 – 20:40

by Tyler DurdenSunday, Mar 14, 2021 – 20:40