So how do the Fed’s shenanigans hurt banks? “The thing about quantitative easing, if you take it in a technical way, the Fed is taking duration out of the market. You can think of duration as another way of talking about bond, risk, or the ability to buy an asset that pays you over time. When the Fed’s doing that, they’re making all of these assets more scarce, and they’re forcing the prices up and the yields down. By definition, the available return of what’s left for a bank to buy is less. That’s what it comes down to.”

https://mises.org/wire/thanks-fed-high-risk-small-time-borrower-becoming-thing-past

Doug French

Banks and accounting trickery go together. Last year, as I remember back to my banking days, financial institutions followed the advice once proffered by one of our board members, “If we’re going to the dump, let’s take a full load.”

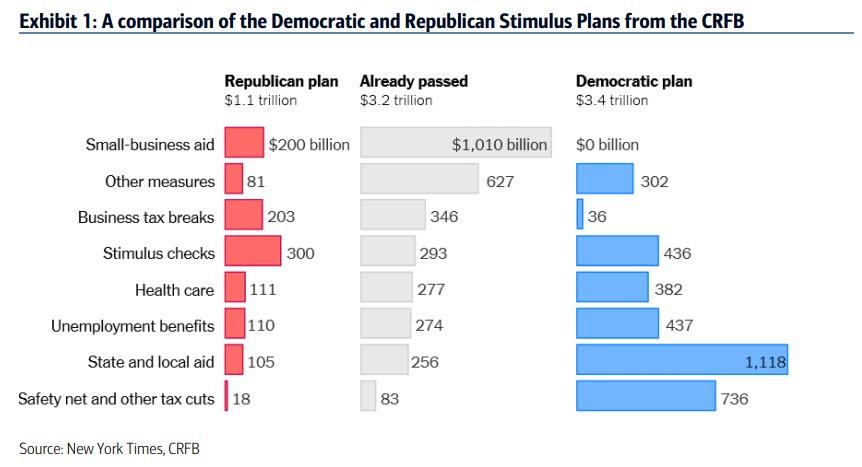

When the pandemic struck, banks dumped plenty in their loan-loss provisions, $60 billion, expecting the worst. The cavalry arrived led by Jerome Powell’s Fed liquidity flood, Steven Mnuchin’s Paycheck Protection Program (PPP) loans, Congress’s Coronavirus Aid, Relief, and Economic Security (CARES) Act, and moratoriums on foreclosures and evictions. Instead of an Austrian business cycle cleansing, the cracks were papered over, including bailing out money market funds, allowing us to watch the pandemic comfortably on TV.

Here we are a year later and banks are rocking their earnings by adding back the money that had been put away for the predicted rainy covid day. Appearing on Real Vision’s Daily Briefing with Jack Farley, bank analyst extraordinaire and Ludwig von Mises fan Chris Whalen said the future of banks could be dim or worse. Mentioning bank darling JPMorgan, Whalen pointed out, “[Y]ou take the reserve release out, their revenues are down year-over-year. Their earnings would have been down year-over-year, and nobody on Wall Street really gets past the first paragraph in the press release, so they don’t bother with this stuff.”

Finding a friendly, promiscuous banker is impossible these days as regulators fight the last war, meaning “banks are continuing to see their assets run off. In other words, they’re not originating new loans fast enough to keep up with the loans that are either being redeemed or prepaying early. A lot of early prepayments, especially in business loans, that kills banks,” Whalen said.

While consumer numbers look good, the lurking problem is commercial real estate. While hiding in plain sight the heavy hand of the government is “letting the banks let these borrowers go [in] the hope that they come back.” Hope is not a good strategy, but “the bank doesn’t want the building. The bank doesn’t want the shopping mall. They’re giving these people time. But I think it’s a mistake, because especially in big cities, we’re going to have to restructure this real estate.”

A person might think the more loan-loss reserves, the better. Whalen says no. Auditors and regulators argue about it all the time. Bank auditors are on red alert for stashing cash in the reserve to smooth earnings or sandbag earnings for tax purposes. Regulators want all the reserves a bank can put away.

“The really big question mark is businesses, urban real estate, multifamily real estate, apartments that haven’t had people paying their rent, all of these are going to be problematic,” Whalen told Farley. “Then down the road, and I mean six months, 12 months down the road, not very far, we got to start thinking about municipal finance, because all the money that Congress put on the table to help New York, help Chicago, that’s going to be gone very quickly.”

The bank analyst said real estate was behind most commercial loans. Regulators, and therefore bankers, love owner-occupied real estate, believing those loans as safe as can be. But in a pandemic, with storefronts boarded up, how safe are they?

In the banking big picture, the Fed’s monetary manipulations are sending the business toward oblivion. “As the banks have grown, their earnings return on earning assets, which is probably the most important thing you look at with any bank that has been falling. It’s fallen 20 basis points in the last three years. We’re down to about 70 basis points,” Whalen said. “I keep telling people if the Fed doesn’t change their policy, by the end of this year, the banks are going to be in trouble.”

Banks aren’t in the risk business anymore. As Whalen told Real Vision, “banks are running away from consumers, the consumer is toxic. The only time a bank wants to face a consumer is if it’s an affluent consumer, a bigger mortgage, high FICO score, low LTV [loan-to-value], cut a loan, no risk.” Other than credit card lending, there is no margin in the lending business anymore.

Back to the loan impairment issue. What banks don’t know is whether their loan books will perform after the government moratoriums are lifted. Says Whalen, “[B]y the summer, the fall, you’re going to be in a position where the auditor is going to force the banks to really start recognizing whether the assets are permanently impaired. That’s when I think we’re going to have to come to Jesus in terms of credit costs.” So, some of that loan-loss reserve money, which conveniently propped up earnings today, may have to be replenished, or worse, the losses may have to be recognized tomorrow.

So how do the Fed’s shenanigans hurt banks? “The thing about quantitative easing, if you take it in a technical way, the Fed is taking duration out of the market. You can think of duration as another way of talking about bond, risk, or the ability to buy an asset that pays you over time. When the Fed’s doing that, they’re making all of these assets more scarce, and they’re forcing the prices up and the yields down. By definition, the available return of what’s left for a bank to buy is less. That’s what it comes down to.”

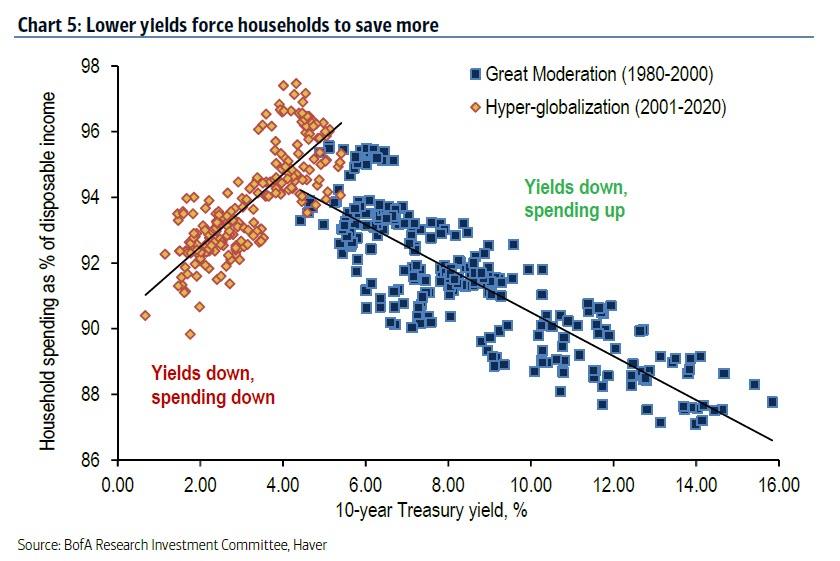

Whalen worries about the Fed and about Janet Yellen at the Treasury, “because these people are playing with a prayer book that’s 30 years old. They don’t really understand how much has changed in this market, and how their manipulation of the market has destroyed price discovery, has destroyed risk metrics. We don’t know what we’ve got here. The only way we’re going to find out is if the Fed ever stops buying, but I don’t think they can. I think the Fed will be buying Treasury bonds forever.”

The Fed is taking the US economy where Europe is, with no freely trading bond market. If Powell is successful, Whalen believes the US will be mired in slow growth and, “[f]rankly, we would have a revolution in this country. You give that a couple of years, and we would be hanging Fed governors from lampposts on Constitution Avenue, which could happen anyway.”

Being Real Vision, Farley had to ask about cryptocurrencies, and Whalen pulled no punches. He believes they are a form of fraud, but “if they want to trade Beanie Babies, great. I think that’s fine.” And he doesn’t believe crypto is decentralized, saying three people in North Korea and China using free electricity are manipulating crypto markets.

Whalen parts with Austrians in saying money is a function of government entities. “You can’t take politics out of money,” he said. “Anybody who makes that argument to you, you know that they’re a child, and that they don’t get it. Countries with strong currencies have big armies and usually nuclear weapons. That’s the way it works.”

The Fed and Treasury are scary, banks are slowly failing, and crypto is a fraud. Other than that, it’s the end of the world and I feel fine. Author:

Doug French

Douglas French is former president of the Mises Institute, author of Early Speculative Bubbles & Increases in the Money Supply, and author of Walk Away: The Rise and Fall of the Home-Ownership Myth. He received his master’s degree in economics from UNLV, studying under both Professor Murray Rothbard and Professor Hans-Hermann Hoppe.

Be seeing you