The post states that Orphan Drug status has been granted for many paediatric treatments. There were pre-existing laws that were intended to stimulate paediatric drug studies. However, the use of paediatric sub-groups to gain orphan status has actually led to less paediatric studies. This would imply that the FDA is looking to greatly tighten up the issuance of Orphan Drug status. Orphan Drug status has conveyed great benefits on the pharmaceutical industry. Firstly, it allows drugs to be tested on smaller populations, greatly reducing costs. Secondly, it has allowed some drugs to be granted orphan drug status, but then go on to be used for treatment of much wider patient population. Thirdly, some large pharmaceutical companies have sought and received orphan drug status for the some of the best-selling drugs in the world.

I don’t get the clickbait post title either.

https://www.zerohedge.com/medical/drugs-dont-work

by Tyler Durden

By Russell Clark of the Capital Flows and Asset Markets substack

This week’s Economist has a leader, criticizing America’s new drug-pricing rules. I knew this was going to be a subpar article when the first line is “A quirk of American law long barred Medicare, the public-health insurer for the elderly, from negotiating with drug firms over prices.” To describe this as a quirk is a stretch. It is almost certainly the product of lobbying buy US drug companies, and at odds with the VA prescription system, also state funded, which is allowed to negotiate drug prices on behalf of its members.

Back in 2017, I published a note on the US healthcare system, explaining how exactly Medicare had come to be abused by many of the drug companies now complaining. I republish it now, as I am working on updating it, and having the old note on the website will be helpful, when I finish the update. I generally don’t like reposts, but this one is useful.

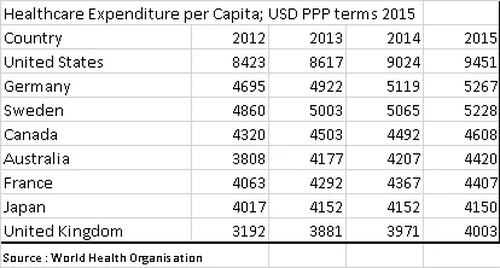

The US Healthcare system is truly extraordinary. Per capita spending on healthcare is double the levels seen in most other developed countries. This is in part driven by a very different set up. Key differences are the private sector has far more freedom to market drugs directly to consumers, and Medicare, the largest buyer of drugs, is prohibited by law from negotiating lower prices. The result is that the US has higher prices for drugs, and due to the extra spend, also has the most innovative drug market. It can be argued that the US subsidises drug development for the rest of the world. However, recent increases in drug prices seem to have been driven by regulatory changes due to the Affordable Care Act (Obamacare), rather than market forces.

In 2016, total US health expenditures were USD 3.3 trillion. US citizens directly paid (out of pocket) for USD 350bn, with the remainder paid by third parties. USD 1.1 trillion was paid for by private health insurance, with Medicare and Medicaid paying USD 1.2 trillion. Finally, USD528 billion was met by a mixture of other government programs, privately raised funds and charities.

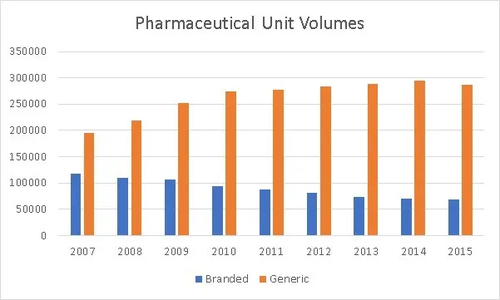

Of the total USD 3.3 trillion spent on healthcare, USD600 bn was spent on drugs, with half on prescription drugs. The other half was spent on drugs used in procedures, and not procured via a prescription. While drug spending has doubled since 2007, we have seen a steady increase in the use of generics at the expense of branded drugs.

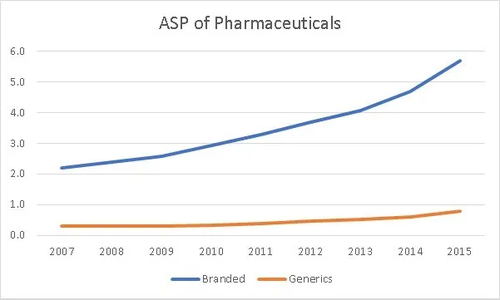

However, even as we have seen volumes decline for branded drugs, we have seen an increase in total spend for branded drugs.

Generic drug spend has also increased significantly in the last few years. Both generic and branded drugs have seen price increases.

The above graphs, would imply that all prescription drugs, both branded and generics have seen price increases. However when we consult data from independent US advisory agency, MEDpac and from the Centre of Medicare and Medicaid Studies (CMS) a different picture appears.

MEDpac looks at Medicare Part D (the part of Medicare that pays for prescription drugs) data from 2009 to 2014. The most striking feature is how the average price for a prescription for a low cost beneficiary has fallen by 24% over the period, while the average drug cost for high cost beneficiaries has risen by 50% over the same period.

Be seeing you