Be seeing you

Posts Tagged ‘Paul Krugman’

Economist Paul Krugman is TOTALLY Wrong On This | Thomas Sowell

Posted by M. C. on February 19, 2025

Posted in Uncategorized | Tagged: Economist, Paul Krugman | Leave a Comment »

German Industry Threatens To Shutter

Posted by M. C. on July 20, 2022

By Patrick Foy

Wrong. It’s not the fault of Putin. Rather it is Germany’s and the EU’s response to Putin, prior to and now in the aftermath of, the Russo-Ukraine war which is at fault. The EU and Berlin took their knee-jerk cue, as always, from the mischief-makers in Washington.

You wanna sanction Russia? You wanna cut off your nose despite your face? You wanna engage in yet another messianic crusade to nowhere? Be my guest. But if you do that, dear crusaders, there will be consequences.

I was lucky tonight. He had a gun, but I had a tire iron.—Phillip Marlowe, 1958

I woke up in Munich with a headache this morning to see an alarming item in the Financial Times, reproduced below. The FT is not part of the underground press. It’s mainstream. Looks like Germany, and hence Europe, and hence the world, is in real trouble. Economic trouble due to Russia’s fisticuffs with Ukraine. Once again, I must say, “Thank you, Washington!”

Never, ever, for one moment forget the immortal words of Victoria Nuland in 2014, ”Fuck the EU!” Washington’s top policy-maker for Europe and chief hands-on architect of the Ukraine fiasco was making an important point.

Did the numskulls in charge of the EU and Germany listen and take heed? No. They continued to dance to the tune blasting from Washington. Hence, the present slow-motion train wreck for Germany, Europe, and the world.

My headache this morning may have been caused by Paul Krugman yesterday. He’s part of the tag-team wise-man duo of the NY Times, the other being the all-knowing Tom Friedman. Krugman wrote yesterday about the recent Euro-Dollar rough parity. The Euro has been falling like a stone.

Krugman, current or ex-professor of economics from Princeton, takes what seemed like forever to explain why—“the meaning of the plunging euro”— before coming to the point. It’s not the surge in interest rates by the FED to fight runaway inflation. No, the central reason is, “…a major downward revision of investors’ views of European competitiveness, and hence of the perceived long-run sustainable value of Europe’s currency.”

And why is that, pray tell? “….over the past couple of decades Europe—especially Germany, the core of the Continent’s economy—has tried to build prosperity on two pillars: cheap natural gas from Russia and, to a lesser extent, exports of manufactured goods to China.” Oh, the horror!

I think it’s called “globalism” or free-enterprise or just taking care of business or whatever. Nothing inherently wrong with that. But now, wait for it, according to Krugman, “…One of these pillars is completely gone thanks to Vladimir Putin’s bungled invasion of Ukraine.” Ah, yes, it’s Putin’s fault! Of course. That “bungled invasion”.

Wrong. It’s not the fault of Putin. Rather it is Germany’s and the EU’s response to Putin, prior to and now in the aftermath of, the Russo-Ukraine war which is at fault. The EU and Berlin took their knee-jerk cue, as always, from the mischief-makers in Washington.

You wanna sanction Russia? You wanna cut off your nose despite your face? You wanna engage in yet another messianic crusade to nowhere? Be my guest. But if you do that, dear crusaders, there will be consequences.

As the German, Jorg Rothermel, says in the FT article, “There is now a danger that we won’t be able to produce certain thing in Germany any more.” To put it crudely, in the words of the unspeakable Nuland, “Fuck the EU!”

When will the Europeans wake up?

Russian gas cuts threaten to shutter Germany industry

Be seeing you

Posted in Uncategorized | Tagged: EU, German Industry, Paul Krugman, Victoria Nuland | Leave a Comment »

Do “Inflationary Expectations” Cause Inflation? Contra Krugman, the Answer Is No

Posted by M. C. on April 9, 2022

So what is the present status of inflation? The official version is that the yearly growth rate of the US Consumer Price Index (CPI) stood at 7.9 percent in February against 7.5 percent in January and 1.7 percent in February 2021. However, in terms of money supply, inflation stood at 7.9 percent in February 2021 against 4 percent in January 2019. Given such massive increases in money supply and given the long time lags from changes in money and changes in prices one should not be surprised that the yearly growth rate of the CPI displays a visible increase.

https://mises.org/wire/do-inflationary-expectations-cause-inflation-contra-krugman-answer-no

n the New York Times article “How High Inflation Will Come Down,” Paul Krugman suggests that the key for future inflation is inflation expectations. Krugman does not think that currently inflation expectations are comparable to the 1980s. According to him:

Forty years ago, as many economists will tell you, inflation was “entrenched” in the economy. That is, businesses, workers and consumers were making decisions based on the belief that high inflation would continue for many years to come. One way to see this entrenchment is to look at the wage contracts—typically for three years—that unions were negotiating with employers. Even then, most workers weren’t unionized, but these deals are a useful indicator of what was probably happening to wage- and price-setting more generally.

Furthermore:

So, what did those wage deals look like? In 1979, union settlements with large companies that didn’t include a cost-of-living adjustment specified an average wage increase of 10.2 percent in the first year and an annual average of 8.2 percent over the life of the contract. As late as 1981, the United Mine Workers negotiated a contract that would raise wages 11 percent annually over the next several years…. Why were workers demanding, and employers willing to grant, such big pay hikes? Because everyone expected high inflation to persist for a long time. In 1980 the Blue Chip Survey of professional forecasters predicted 8 percent annual inflation over the next decade. Consumers surveyed by the University of Michigan expected prices to rise by about 9 percent annually over the next five to 10 years. With everyone expecting inflation to continue, workers wanted raises that would keep up with rising prices, and employers were willing to grant those raises because they expected their competitors’ costs to be rising as fast as their own. What this did, in turn, was make inflation self-perpetuating: Everyone was raising prices in anticipation of everyone else raising prices. Ending this cycle required a huge shock—an economy so depressed both that inflation fell and that workers were compelled to accept major concessions.

This time around, Krugman holds, things are different:

Back then almost everyone expected persistent high inflation; now few people do.Bond markets expect inflation eventually to return to pre-pandemic levels. While consumers expect high inflation over the next year, their longer-term expectations remain “anchored” at fairly moderate levels. Professional forecasters expect inflation to moderate next year. This means that we almost surely aren’t experiencing the kind of self-perpetuating inflation that was so hard to end in the 1980s. A lot of recent inflation will subside when oil and food prices stop rising, when the prices of used cars, which rose 41 percent (!) over the past year during the shortage of new cars, come down, and so on. The big surge in rents also appears to be largely behind us, although the slowdown won’t show up in official numbers for a while. So it probably won ‘t be necessary to put the economy through an ’80s-style wringer to get inflation down.

Given all this, Krugman holds, history tells us that we are not moving to rampant inflation as we did in the 1970s:

Be seeing you

Posted in Uncategorized | Tagged: Bond markets, CPI, Inflationary Expectations, Paul Krugman | Leave a Comment »

No, Inflation Is Not Good for You | Mises Wire

Posted by M. C. on November 23, 2021

Whatever temporary gains many workers are experiencing with higher wages, the euphoria is not likely to last long. Furthermore, one doubts that this current bout of inflation is as temporary as Paul Krugman recently claimed. The US economy more and more seems to be running on empty and this means that monetary authorities are going to pump even more new money into the system. Don’t count on this being a windfall for anyone but the wealthiest among us.

https://mises.org/wire/no-inflation-not-good-you

With the recent rise in inflation—with subsequent increases in both consumer and producer price levels—one suspects that sooner or later people on the left either would downplay it or find a way to spin the bad news into something positive like an alchemist would want to spin straw into gold. Both accounts have arrived, thanks to the New York Times and the hard-left publication, The Intercept.

The various accounts in the Times hardly are surprising, given the link the paper has to the nation’s political, economic, and academic elites, and given that these are the people that have created the inflation problem in the first place. Not surprisingly, the NYT “experts” (because progressives believe that the “experts” always have the right answers) are playing down the latest spikes as temporary and related to current issues of supply and demand, not any unprecedented increases in the nation’s money supply.

We should not be surprised that the NYT’s resident economic “expert,” Paul Krugman, has debunked any worries of inflation and especially inflation over the long term, instead likening the current price spikes to what happened after World War II ended and the economy moved from one dedicated to total war to one producing capital and consumption goods. Likewise, President Joe Biden is touting an endorsement of his “Build Back Better” initiatives by a number of Nobel economics winners who have claimed the proposed programs included in the legislation would reduce inflation. (One should not forget that while Krugman is a Nobel recipient, his NYT columns go well beyond any economic analysis, establishing him as little more than a partisan political shill.)

There is an important point to be made here: all of these “experts” are willing to say they believe inflation is a problem for most people and the disagreement isn’t so much about the real and potential harm inflation brings, but rather the duration of the current spikes. However, there also exists among radical progressives a belief that inflation actually is a good thing because, in their minds, it transfers wealth from the rich to the poor.

The first time I saw this theme was in an article by the Marxist journalist Alexander Cockburn, who at one time had a regular column in the Wall Street Journal. Writing about the alleged “Hitler Diaries” supposedly unearthed in the early 1980s (and later exposed as forgeries), Cockburn said if one actually could mine Hitler’s thoughts, they would find that he didn’t see the hyperinflation that ravaged Germany in the 1920s as any kind of a threat, and that it actually was good for the economy. (I’m writing from memories, as I have not been able find this column in the WSJ archives.)

Be seeing you

Posted in Uncategorized | Tagged: Alexander Cockburn, inflation, Paul Krugman | Leave a Comment »

Why Empowering Organized Labor Will Definitely Not Help the Economy | Mises Wire

Posted by M. C. on April 26, 2021

The Reagan-killed-the-unions myth came about because of Reagan’s response to the air traffic controllers’ strike in 1981. The union, which had the acronym PATCO (Professional Air Traffic Controllers Organization), actually endorsed Reagan in 1980 (along with the Teamsters—because Reagan agreed to delay trucking deregulation for two years, something Krugman ignores).

https://mises.org/wire/why-empowering-organized-labor-will-definitely-not-help-economy‘

Paul Krugman has a very prominent perch from the editorial page at the New York Times and he has used his influence, among other things, to shill for two things that are anathema to a strong economy: inflation and organized labor. My analysis examines what Krugman says about labor unions and explains why once again his economic prognostications are off base.

In a recent column, Krugman declares that the present political climate may reverse the long trend in private sector unionism—and that is a good thing:

The political environment that gave anti-union employers a free hand may be changing—the decline of unionization was, above all, political, not a necessary consequence of a changing economy. And America needs a union revival if we’re to have any hope of reversing spiraling inequality.

As he often does, Krugman presents a scenario of a prosperous America in which organized labor helped create a productive and happy society, although one might question his knowledge of history. He writes:

America used to have a powerful labor movement. Union membership soared between 1934 and the end of World War II. During the 1950s roughly a third of nonagricultural workers were union members. As late as 1980 unions still represented around a quarter of the work force. And strong unions had a big impact even on nonunion workers, setting pay norms and putting nonunion employers on notice that they had to treat their workers relatively well lest they face an organizing drive.

While he is partly correct in his statement, Krugman then paints an alternate picture of history, claiming, in effect, that the source of economic growth is high factor prices.

And this decline in unionization has had dire consequences. In their heyday, unions were a powerful force for equality; their influence reduced the overall inequality of wages and also reduced wage disparities associated with different levels of education and even race. Surging union membership appears to have been a key factor in the “Great Compression,” the rapid reduction in inequality that took place between the mid-1930s and 1945, turning America into a middle-class nation.

First, and most important (and maybe most shocking), the 1930s constituted the Great Depression, when unemployment was in double digits and living standards for many Americans fell from their levels a decade before. The notion that the Roosevelt administration “created” a middle class by putting people out of work is preposterous on its face.

Second, Robert Higgs forcefully destroyed the lie that the US economy during World War II brought prosperity and helped turn the country into a “middle-class nation.” Such thinking only can reflect a mindset that sees the US economy as being “managed” by the state, and that middle-class incomes are solely a function of state power to confiscate income from some and turn it over to others. To take a time when the nation was in an economic crisis and later involved in the most destructive war in history and then present it as a permanent model for society is perverse beyond words.

To better understand why Krugman would write such things, we need to understand his view of the economy, a view shared, apparently, by most political, academic, and social elites in this country. In the Krugman view—and I will try to keep from veering into presenting a caricature of his beliefs—private enterprise rests on a tenuous foundation. Like J.M. Keynes, he believes that the economy is circular in nature.

More than a decade ago, I wrote that Krugman and others see the economy as being like a “perpetual motion machine” in which individual savings actually work against economic prosperity:

If I can put the whole Keynesian set of fallacies into one statement, it would be this: the modern Keynesians believe that the economy operates like a perpetual motion machine, with government spending being the “grease” that keeps it from slowing down. The “friction” in this economic machine, according to the pundits, is private saving. Eliminate it, and the economy goes on forever, adding energy and expanding indefinitely.

I continue:

[I]f consumers save or “hoard” some of their money, then there will be a “leakage” from the system, which means that households cannot “buy back” the products they have produced. The unpurchased goods then pile up in the inventories, so businesses must then cut back production and lay off workers. This further triggers consumer uncertainty, which means they save even more money, and we are off to the downward races.

Krugman has used this analysis to explain every economic downturn, including the Great Depression, and since he left the Princeton University faculty to dedicate his academic work to examining what he calls income inequality, he has doubled down on his rhetoric. In his view, business firms create goods which people purchase, and the income ultimately flows back to business owners, making them wealthy.

As long as these wealthy business owners continue to spend all of their income either on consumption goods or new capital, the economy can move along. The likelihood of that chain of events happening, however, is near zero and, instead, the wealthy often will save (read: hoard) much of their income. Instead of buying cars, yachts, jewelry, and whatever else the rich like to purchase, and instead of putting back the rest of their income to purchase new capital or replenish existing capital, they stuff the money into nonproductive accounts and don’t spend at all.

On top of that, Krugman holds to the Thomas Piketty theme that over time wealthy people receive increasing returns to the capital they own so that we see the proverbial scenario of “the rich getting richer and the poor becoming poorer.” Once that becomes a guiding narrative, of course, everything that happens seems to fulfill the Krugman-Piketty theme.

Over time, hoarding by the rich throws sand into the gears of the perpetual motion machine, grinding the economy to a halt and throwing it into recession. While pundits like Karl Marx, Keynes, and Krugman will deviate among themselves as to the causes of economic downturns, they generally agree that the system implodes from within and only can be turned around by massive governmental involvement.

The Keynes-Krugman “solution” to this obvious problem is for government to create a system of massive wealth transfers from the wealthy to everyone else. High wages generated through labor union activism, high marginal tax rates, and a huge welfare system serve to take income away from the wealthy, give it to others who will continue to spend and keep the perpetual motion machine well oiled and moving. Thus, high taxes and high wages obtained via coercive activities by organized labor actually help everyone from the poorest people to the wealthy business owners. Lower-income people receive money, goods, and services while the wealthy find that their enterprises flourish when people have more money to spend. It is win-win for everyone.

Given his tendency to mangle economic history, it is not surprising that Krugman falsely blames Ronald Reagan for the decline of labor unions just as he falsely claims that organized labor created prosperity. He writes:

See the rest here

Author:

William L. Anderson is a professor of economics at Frostburg State University in Frostburg, Maryland.

Be seeing you

Posted in Uncategorized | Tagged: Organized Labor, PATCO, Paul Krugman, Reagan, Teamsters | Leave a Comment »

EconomicPolicyJournal.com: LSD-Trip Commentary From Paul Krugman; I Had to Play it Back Three Times

Posted by M. C. on March 19, 2021

Krugman did say that the 1970s stagflation was “more myth than reality.”

So I went to a real authoritative economics text, the college textbook written by Krugman and his wife Robin Wells, Macroeconomics. This is what it has to say about the 1970s:

Stagflation was the scourge of the 1970s: the two deep recessions of 1973-1975 and 1979-1982 were both accompanied by soaring inflation.

https://www.economicpolicyjournal.com/2021/03/lsd-trip-commentary-from-paul-krugman-i.html

This past Sunday, Paul Krugman appeared on the CNN show, “Fareed Zakaria GPS.”

He was there to debate Larry Summers about the Biden $1.9 trillion spending package. Quite correctly, Summers warned about the potential price inflationary consequences of the spending.

As per usual, Krugman’s commentary sounded as though he could have been an added line to the lyrics for White Rabbit. By defending the massive spending bill as non-inflationary, he could have easily been mistaken for a past adviser to Gideon Gono when he was Zimbabwe’s central banker.

But the most remarkable Krugman stunner during the show was that for some odd reason he sought to deny the stagflation of the 1970s. It was like he was having an extended Joe Biden moment.

He actually said that 1970s stagflation was “more myth than reality” (stagflation is simultaneously climbing unemployment and price inflation).

The first time, I heard it, I thought I missed something. Since I record all major news talk shows on my YouTube TV for moments just like this, I replayed his comment 3 times. I did hear correctly the first time.

Krugman did say that the 1970s stagflation was “more myth than reality.”

So I went to a real authoritative economics text, the college textbook written by Krugman and his wife Robin Wells, Macroeconomics. This is what it has to say about the 1970s:

Stagflation was the scourge of the 1970s: the two deep recessions of 1973-1975 and 1979-1982 were both accompanied by soaring inflation.

And that was the case. Unemployment and inflation during the period were the highest in the more than 70 years surrounding the period. (Red lined year in the charts below).

Unemployment Rate 1950-2019

Consumer Price Inflation 1950-2020

Krugman really just makes things up. It doesn’t appear to matter that it contradicts fact or what he said before. I am beginning to think he is a Leninist-opportunist, either that or he is tripping on a steady dose of real bad acid.

–RW

Be seeing you

Posted in Uncategorized | Tagged: inflation, Paul Krugman, stagflation | Leave a Comment »

Wind Power Is a Disaster in Texas, No Matter What Paul Krugman Says | Mises Wire

Posted by M. C. on March 10, 2021

https://mises.org/wire/wind-power-disaster-texas-no-matter-what-paul-krugman-says

In the wake of February’s tragic power outages in Texas, during which 4.5 million households suffered service interruptions, partisans on both sides have been quick to interpret the events as confirmation of their preferred energy policies. With news images of helicopters deicing frozen turbines, conservatives lambasted Texas’s increasing reliance on wind power as the villain in the story.

Trying to temper this knee-jerk reaction, Reason.com columnist Ron Bailey argued that “[m]ost of the shortfall in electric power generation during the current cold snap is the result of natural gas and coal powered plants going offline.” And Paul Krugman for his part declared that it was a “malicious falsehood” to blame wind and solar power for what happened in Texas, as it was primarily a failure of natural gas.

In this article I’ll lay out the basic facts of which power sources stepped up to the plate during the crisis. Contrary to what you would have known from reading Ron Bailey (let alone Paul Krugman), when the Texas freeze hit, electricity from natural gas skyrocketed while wind output fell off a cliff. The people arguing that wind wasn’t to blame mean it in the same way Jimmy Olson wasn’t to blame when General Zod took over: wind is so useless nobody serious ever thought it might help in a crisis.

Krugman on Texas Electricity

In his February 18 column titled “Texas, Land of Wind and Lies,” Krugman declared that

Republican politicians and right-wing media … have coalesced around a malicious falsehood instead: the claim that wind and solar power caused the collapse of the Texas power grid, and that radical environmentalists are somehow responsible for the fact that millions of people are freezing in the dark …

In contrast to this dirty rotten lie from the right-wingers, Krugman instead explains:

A power grid poorly prepared to deal with extreme cold suffered multiple points of failure. The biggest problems appear to have come in the delivery of natural gas, which normally supplies most of the state’s winter electricity, as wellheads and pipelines froze.

A bit later in the article Krugman admits that wind was involved as well, but minimizes its role in this way:

It’s true that the state generates a lot of electricity from wind, although it’s a small fraction of the total. But that’s not because Texas—Texas!—is run by environmental crazies. It’s because these days wind turbines are a cost-effective energy source wherever there’s a lot of wind, and one thing Texas has is a lot of wind.

It’s also true that extreme cold forced some of the state’s insufficiently winterized wind turbines to shut down, but this was happening to Texas energy sources across the board, with the worst problems involving natural gas.

Incidentally, there are literally no numbers in Krugman’s article (except for numerals referring to dates), which is a signal that he’s pulling a fast one on his readers. From his qualitative (not quantitative) description, most people would have assumed that when the unusually cold weather hit Texas last month, electricity generation from various sources was down across the board, but that it mostly fell from natural gas, while the drop in wind was insignificant. As I’ll show in the next section, this is utterly false.

What Really Happened During Texas’s Power Crisis

Had I not seen the analysis from my former colleagues at the Institute for Energy Research (see their articles here and here), I might have believed the spin that the Texas crisis was really a failure of fossil fuels rather than renewables. Yet as we’ll see, the actual numbers tell a much different story from what most Americans probably “learned” from the media discussion.

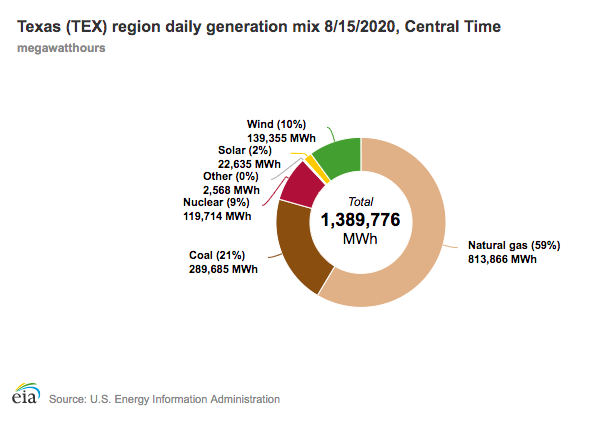

The simplest way for me to communicate the relevant information is through three infographics, generated from the Energy Information Administration’s handy tool that shows the source mix for daily energy generation by state.

Before showing the numbers, I need to make an important clarification: the demand for electricity soared to unprecedented levels during the freeze. In particular, on February 14, peak demand on the electric grid surpassed sixty-nine gigawatts, breaking the previous winter record of (almost) sixty-six gigawatts set in 2018. It was in the early hours of the following morning (February 15) that the Electric Reliability Council of Texas (ERCOT) implemented rolling blackouts to prevent the entire grid from collapsing. So to be clear, the issue wasn’t that supply in an absolute sense fell, but rather that demand soared. (Texas typically uses more electricity in the summer to keep things cool, rather than in the winter to keep things warm.)

With that context in place, here are the stats for electricity output from various sources on February 15, 2021:

2021.03_texas_feb_15_2021.png

Already we see something interesting. Of the total amount of electricity delivered on this first day of blackouts, 65 percent came from natural gas, while only 6 percent came from wind and 2 percent from solar.

But in fairness, maybe what guys like Krugman meant is that this is much lower than what we normally could expect from natural gas. (Remember Krugman had said that natural gas “normally supplies most of the state’s winter electricity.”)

To test this possibility, we can look at the situation one year prior, on February 15, 2020:

2021.03_texas_feb_15_2020.png

Now, this is interesting. A year earlier, during a normal mid-February day, natural gas “only” supplied 43 percent of the total electricity, whereas wind accounted for 28 percent and solar was the same at 2 percent. Remember how Krugman said wind was only a “small fraction” of Texas generation? Overall for the year 2020, wind produced 22 percent of Texas’s electricity, a higher share than coal.

Yet besides the proportions, also look at the absolute quantity of electricity generated: on Feb. 15, 2020, natural gas produced 398,130 megawatt hours (compared to 759,708 MWh during the recent freeze), while wind produced 264,024 MWh (compared to 73,395 MWh during the freeze).

To sum up, compared with the same date a year earlier, during the first day of the blackouts in Texas, electricity from natural gas was 91 percent higher, while electricity from wind was 72 percent lower.

To reiterate the clarification I gave earlier, part of the confusion here is that electricity demand in February isn’t normally as high as it was because of the freeze. So to test whether natural gas is the culprit, we can compare the generation from various sources during the freeze to the situation back during the summer. For example, let’s look at how things stood on August 15, 2020:

2021.03_texas_aug_15_2020.png

As our date occurred in the dog days of summer, total electric demand was higher in mid-August 2020 than on February 15, 2021.

See the rest here

Author:

Robert P. Murphy is a Senior Fellow with the Mises Institute. He is the author of many books. His latest is Contra Krugman: Smashing the Errors of America’s Most Famous Keynesian. His other works include Chaos Theory, Lessons for the Young Economist, and Choice: Cooperation, Enterprise, and Human Action (Independent Institute, 2015) which is a modern distillation of the essentials of Mises’s thought for the layperson. Murphy is cohost, with Tom Woods, of the popular podcast Contra Krugman, which is a weekly refutation of Paul Krugman’s New York Times column. He is also host of The Bob Murphy Show.

Be seeing you

Posted in Uncategorized | Tagged: Institute for Energy Research, Natural gas, Paul Krugman, texas, Wind power | Leave a Comment »

EconomicPolicyJournal.com: The Worst Column Paul Krugman Has Ever Written

Posted by M. C. on March 3, 2021

https://www.economicpolicyjournal.com/2021/03/the-worst-column-paul-krugman-has-ever.html

The Worst Column Paul Krugman Has Ever Written

In his latest New York Times column, Paul Krugman writes:

It’s true that both Economics 101 and conservative ideology say that more choice is always a good thing. Milton Friedman’s famous and influential 1980 TV series extolling the wonders of capitalism was titled “Free to Choose.”

The spread of this ideology has turned America into a land where many aspects of life that used to be just part of the background now require potentially fateful decisions. You don’t get a company pension, you have to decide how to invest your 401(k)…

Some, maybe even most, of this expansion of choice was good. I don’t miss the days when all home phones were owned by AT&T and customers weren’t allowed to substitute their own handsets.

But the argument that more choice is always good rests on the assumption that people have more or less unlimited capacity to do due diligence on every aspect of their lives — and the real world isn’t like that. People have children to raise, jobs to do, lives to live and limited ability to process information.

And in the real world, too much choice can be a big problem… I’d suggest that an excess of choice is taking a psychological toll on many Americans, even when they don’t end up experiencing disaster…

So the next time some politician tries to sell a new policy — typically deregulation — by claiming that it will increase choice, be skeptical. Having more options isn’t automatically good, and in America we probably have more choices than we should.

How idiotic can a New York Times columnist get?

More choices mean more flexibility and if there develops a situation where it is too difficult for many to choose via myriad options, why wouldn’t the market develop simple options?

This is probably Krugman’s worst column he has ever written.

It presents an absurd scenario where the only solution is less choice for all and more government authoritarianism.

Krugman is clearly out front, ahead of the pack, for the 2021 Stalin Award. –RW

Be seeing you

Posted in Uncategorized | Tagged: Free to Choose, Paul Krugman | Leave a Comment »

Paul Krugman’s Hilarious 2015 Bitcoin Prediction and the Value of Intellectual Humility

Posted by M. C. on February 12, 2021

A $7,500 investment in bitcoin in 2015, when economist Paul Krugman described it as “bubble” rooted in “libertarian ideology,” today would be worth $1.2 million.

In 1998, Paul Krugman predicted that by 2005 it would be clear that “the Internet’s impact on the economy has been no greater than the fax machine’s.”

The prediction was so wrong and so widely circulated that Snopes has a page fact-checking the claim and affirming its veracity.

The internet is a vast place, but one would be hard-pressed to find another prediction that missed so badly. Which is why I was surprised to stumble across a 2015 prediction on bitcoin that whiffed just as wildly.

Coincidently (or perhaps not), this comment also comes from Krugman.

Bitcoin a ‘Bubble’ Rooted in ‘Libertarian Ideology’

During a July 2015 roundtable discussion, Krugman was asked for his take on “disruptive digital currencies such as bitcoin.”

In a rambling two and a half minute response, Krugman described bitcoin as a currency rooted in “libertarian ideology,” a bubble that was just waiting to pop.

“It’s a technically sweet solution to a problem, but it’s not clear that problem has much economic relevance,” the Nobel Laureate explained.

The problem is, it’s clear Krugman didn’t understand those technical issues. He goes on to compare bitcoin to credit cards.

“If you’re looking for the idea that a currency doesn’t have to be something physical, it can be something virtual, that’s the system we already have,” he says. “If I want a way to make payments electronically, that’s, you know, credit cards.”

Krugman’s response suggests he had not actually studied bitcoin and didn’t really understand its value proposition or unique properties. Bitcoin has many of the same attributes as fiat money—it is easily transferable, divisible and fungible—but unlike fiat money, its supply is predictable and strictly limited.

Hubris among intellectuals isn’t exactly unheard of, but it’s a bit astonishing coming from Krugman, whose history is replete with whacky predictions and bad advice.

By design, bitcoin is increasingly difficult to create (“mine”). And, we know for a certainty that just 21 million bitcoins will be produced. This inherent scarcity makes bitcoin a far more durable form of currency than fiat money, an attribute that has nothing to do with credit cards.

Instead of discussing the attributes of bitcoin or even going into its weaknesses, Krugman mostly scoffs at cryptocurrencies and offers this bit of financial advice.

“Bitcoin looks like it really is a bubble in multiple senses,” Krugman says. “Certainly, [there’s] not a reason to hold that currency.”

If You Had Ignored Krugman’s Advice and Bought Bitcoin

If you listened to Krugman and decided to not buy bitcoin in 2015, you probably feel a bit like Blockbuster after turning down a $50 million offer to buy Netflix.

When Krugman made this prediction in July 2015, bitcoin was trading at roughly $300. On Thursday morning, bitcoin was trading at $47,500. This means that if you decided to ignore Krugman’s advice and buy 25 bitcoins for $7,500, you’d have nearly $1.2 million today.

To be fair to Krugman, predicting the future is hard. We live in a complex world with infinite moving parts. But we should acknowledge that.

Let’s look at it another way. Krugman was earning a $225,000 annual salary from City University of New York in 2015 (to study income inequality), a sum that does not include earnings from other ventures (book royalties, his New York Times column, etc.). If for one year Krugman bought bitcoin instead of stocks with ten percent of his income (pre-tax), he could have purchased 75 bitcoin for $22,500. That single investment would have netted him a $3.6 million profit.

Acknowledging the Limits of Knowledge

To be fair to Krugman, predicting the future is hard. We live in a complex world with infinite moving parts. Our knowledge of the world—systems, choices, products, risks, etc.—is limited.

But we should acknowledge that. This awareness, the Nobel Prize winning economist F.A. Hayek pointed out, will in turn teach us a certain amount of intellectual humility.

“To assume all the knowledge to be given to a single mind…is to disregard everything that is important and significant in the real world,” Hayek wrote in The Use of Knowledge in Society.

Krugman’s response is stark contrast to how fellow progressive Noam Chomsky responded when asked about bitcoin during a 2015 interview.

Alas, admitting the limits of knowledge is not something Krugman is known for. And it comes through when he all but sneers when asked about bitcoin, provoking laughter from the audience and the moderator.

This is a stark contrast to how fellow progressive Noam Chomsky responded when he was asked about bitcoin during a 2015 interview. Chomsky expressed skepticism, but he also acknowledged he hadn’t studied bitcoin closely.

“My first mind is that I don’t know enough to answer,” Chomsky said. “I looked into it to an extent, and the guesses seem to be pretty uncertain.”

It’s a far more refreshing answer than Krugman’s glib take.

Hubris among intellectuals isn’t exactly unheard of, but it’s a bit astonishing coming from Krugman, whose history is replete with whacky predictions and bad advice that turned out to be rather embarrassing. This ranges from a 2002 plea to intentionally create a housing bubble to fight recession (how did that housing bubble work out?), to empirical failures of his macroeconomic models, to the aforementioned claim that the internet’s economic impact would be “no greater than the fax machines.”

Again, it’s okay to be wrong about things. We’re human, we all make mistakes. But recognizing this basic truth should breed humility, not arrogance, and the ability to admit when we’re wrong.

Bullish on Bitcoin

Krugman remains a crypto skeptic, evidenced by columns in 2017 and 2018, and that’s okay. At least it looks like he’s done more homework since then. His primary hang-up is the idea that bitcoin is “untethered” in contrast to gold (which has intrinsic value) and fiat money (which is backed by government promises).

“If speculators were to have a collective moment of doubt, suddenly fearing that Bitcoins were worthless, well, Bitcoins would become worthless,” writes Krugman.

This is true, of course, but it could also be said of any currency (even gold).

I’ll admit that I had similar skepticism about bitcoin for years. Its value as a flexible but durable currency designed to be scarce was elusive and difficult to fully believe.

I don’t feel that way anymore. The value proposition as a durable currency resistant to inflation is real, especially at a moment when fiat money looks precarious because of mass pumping.

I bought my first crypto this week. Time will tell if the investment was wise or foolish.

But I promise one thing: If I’m wrong, I’ll admit it

Jon Miltimore

Jonathan Miltimore is the Managing Editor of FEE.org. His writing/reporting has been the subject of articles in TIME magazine, The Wall Street Journal, CNN, Forbes, Fox News, and the Star Tribune.

Bylines: Newsweek, The Washington Times, MSN.com, The Washington Examiner, The Daily Caller, The Federalist, the Epoch Times.

Be seeing you

Posted in Uncategorized | Tagged: Bitcoin, crypto skeptic, Digital Currencies, Intellectual Humility, Paul Krugman | Leave a Comment »

EconomicPolicyJournal.com: Krugman Calls for Price Controls

Posted by M. C. on April 4, 2020

https://www.economicpolicyjournal.com/2020/04/krugman-calls-for-price-controls.html

It is difficult to believe that Paul Krugman was trained as an economist.

He is now calling for price controls.

It is precisely during a crisis that it is more important than ever for price signals to be in operation so that businessmen and entrepreneurs know where to direct their skills, talent and product.

Price controls distort these signals and result in less of the most important products demanded to be produced and delivered.

–RW

Be seeing you

Posted in Uncategorized | Tagged: Paul Krugman, price controls, price signals | Leave a Comment »