Modern monetary theory, which is now experiencing its fifteen minutes of fame, contains a number of strange and counterintuitive propositions. Proponents claim that these propositions are not an economic theory, only an accounting identity. One of these is that the private sector can save only if the government runs a deficit. Within the self-consistent, tail-chasing world of MMT, these statements are true by definition. However, when MMT aphorisms are interpreted using their normal meaning in the English language, their conclusions are not only false, but foolish.

MMT defines savings as the accumulation of non–private sector assets. It must be the case that all liabilities between private sector actors net out to zero. And from that, the only way that the private sector can have a positive net credit is if something outside of it has a negative net. That something is the government (perhaps, but probably not so, as I will argue later).

The Definition of Saving

A good definition enables people to have a conversation about a topic by establishing a shared meaning. While anyone is free to define “up” to mean down and vice versa, Humpty Dumpty notwithstanding, a good definition, to avoid confusion, should be consistent with normal usage. In normal English, savings consist of what is produced and not consumed. I will show that using this definition it is possible for the private sector to save without a government deficit.

The first and simplest form of savings is saved consumption goods. Long duration goods such as homes, cars, appliances, clothing, and furniture are produced and then release their services over time. The US private sector has about $33 trillion of residential real estate, which consists of saved real estate services in the form of homes that will be used up over decades. Shorter duration consumption goods can also be saved, such as frozen food or tinned sardines, extra tubes of toothpaste, and in the days of the virus we must not underestimate the importance of saved toilet paper. Businesses also have saved inventories of consumption goods which they plan to sell in the near future.

The Role of Saved Capital Goods

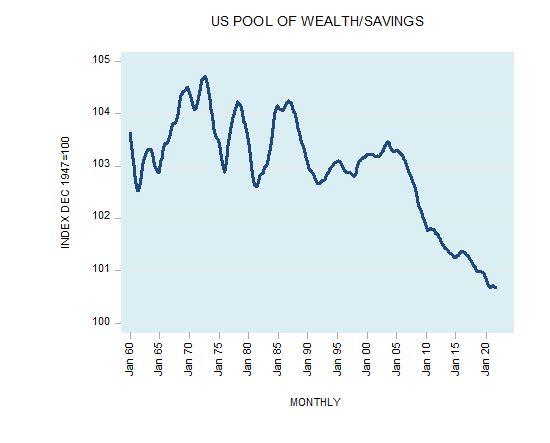

The second and more important form of savings is saved capital goods. These are productive assets which, in the exact same way as saved consumer goods, have been produced but not consumed. According to the Fed, the United States has $56 trillion of saved capital goods. Some of that might be owned by governments, but even a fraction of the value held in private hands is an enormous amount. The importance of capital goods is that they are needed in order to produce consumption goods. Labor productivity depends on the amount of capital that workers have, which drives real wages. The gradual increase in our standard of living over the centuries is attributable to the quantity and quality of saved capital goods.

Even the Robinson Crusoe stranded on an island may save consumption goods such as caught and dried fish, harvested and stored coconuts and tubers. Crusoe may also save capital goods—such as a fishing rod, a net, or a ladder to harvest coconuts from trees—by creating them faster than they wear out.

Savings and Cash Balances

Another common usage of the term “savings” is cash balances. While MMT correctly points out that one person’s spending is another’s income, and therefore nets out to zero, the private sector cannot accumulate a net cash balance unless there are money flows in and out of it. In a gold monetary system, the private sector could accumulate cash through mining. But assuming for the moment that there are no cash flows between the private and government sector, and no money creation, the private sector cannot net accumulated cash. However, the private sector can increase its real cash balance through lower prices. This happens when the public preference for cash relative to goods changes in the cash direction.

The Problem with the MMT Definition of Savings

At this point we can see the main problem with MMT’s definition of savings as net government debt. Assets can be divided into two broad categories: debt and equity (equity being what you own and debt being what is owed). Every debt has two sides: the creditor, for whom it is an asset, and the debtor, for whom it is a liability. Net debt must balance to zero if you include both sides in your aggregate. Equity, being unencumbered, and having only one side, is a positive value, and can grow. An increase in one person’s equity in the form of saved capital or consumer goods does not require an offsetting debit anywhere else. To see this, consider Robinson on his ancap island, busily drying fish and storing coconuts. His gross equity increases on a daily basis without any offsetting liability anywhere in the South Pacific. MMT’s definition is incomplete, because it looks only at the debt component of assets while ignoring the equity.

Private sector net debt is always zero by definition. This truism tells us nothing interesting about the world and is only another way of stating the definition of debt. Private sector gross assets in the form of saved capital and consumer goods are the foundation of our economic well-being and are therefore quite important. Contrary to MMT, the proper object of study should be gross savings rather than net savings. Net assets in the form of external debts to foreign countries are not uninteresting for some purposes, but must be paid for out of either current or future production, which depends on the gross savings.

Now I will return to the issue of whether the private sector’s net position in the government debt market is truly an asset. Government debt could in theory be paid by selling government assets (and in some cases they have done so) but in most cases, government debt represents a claim on the taxing power of the government in question. And the tax liability is to a large extent owed by the same private sector that owns the bonds. Every increase in government debt imposes a future tax liability of the same amount on the same private sector. If we disaggregate down to the individual or household, some individuals owe more in tax than they own in government bonds, and others the opposite. While I am not a believer in Ricardian equivalence, the net positive asset position of the private sector in government bonds is offset by an equal tax liability on the aggregate level.

Many parts of MMT depend on the issuer of debt also being the monetary sovereign—the body that can create money out of nothing. It should be noted that this particular issue does not apply only to the issuer of government money. As long as the definition of the private sector excludes all governments of any level who borrow in the bond market, the same accounting identity applies. State and municipal governments could create MMT savings by borrowing. MMT might dispute my point about sovereign debt imposing a tax liability on the private sector on the grounds that the monetary sovereign can print and spend money into existence “for free” (i.e., without imposing any cost on the rest of society). I will not address that point here, but Robert Murphy has elsewhere.

Capital goods and consumer goods can be accumulated without any requirement in an accounting sense for obligations between the government and the private sector. If the government had no debt, it would enable the private sector to accumulate even more savings, because it would be freed of the tax liability.

You can define the word “savings” to mean anything you want. MMT savings defined as net government debt holdings enables the MMT tautology that the private sector cannot MMT save without the government running a deficit. However, this does not tell us anything useful. If anything, MMT saving should be discouraged, because the government drains resources from the domain of economic calculation and private property to socialism and government control. The focus should be on economic policies that enable private individuals and business firms to accumulate gross savings in order to improve our well-being.