Posts Tagged ‘the Fed’

U.S. Rep. Matt Rosendale On How The Fed Enables Big Government

Posted by M. C. on October 29, 2024

Posted in Uncategorized | Tagged: Big Government, Matt Rosendale, the Fed | Leave a Comment »

Obama’s chief economist wants more inflation!

Posted by M. C. on August 26, 2023

What do they smoke in DC?

Furman’s illogical proposal exemplifies the erroneous thinking in the economics profession in general and at the Federal Reserve specifically. For example, the “natural” inflation rate is below zero, i.e., deflation. Thus, the Fed’s policy goal to target a 2 percent inflation rate is fatuous.

As Murray Rothbard pointed out, “rather than a problem to be dreaded and combatted, falling prices through increased production is a wonderful long-run tendency of untrammelled (sic) capitalism.

https://murraysabrin.substack.com/p/obamas-chief-economist-wants-more

Note: If you become an annual paid subscriber, you will receive an autographed copy of my memoir. Please send me your address and I will mail you my book.

Robert Wright’s review of my book captures the essence of my journey in America.

Murray’s Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

“There is a right way and a wrong way, always choose the right way.” Abraham Sabrin (1914-2001)

Jason Furman was Obama’s chairman of the Council of Economic Advisers (2013-2017) and is currently a professor of the practice of economic policy at Harvard. In an Wall Street Journal op-ed yesterday, “The Fed Should Carefully Aim for a Higher Inflation Target,” Furman asserts, “In the short run, the Fed should be aiming to stabilize inflation below 3%. If it can achieve this goal, then it should shift to a higher target range for inflation when it updates its overall strategy around 2025” (emphasis added.)

Furman’s illogical proposal exemplifies the erroneous thinking in the economics profession in general and at the Federal Reserve specifically. For example, the “natural” inflation rate is below zero, i.e., deflation. Thus, the Fed’s policy goal to target a 2 percent inflation rate is fatuous. In a free market economy as the output of goods and services increases prices in general should decline.

As Murray Rothbard pointed out, “rather than a problem to be dreaded and combatted, falling prices through increased production is a wonderful long-run tendency of untrammelled (sic) capitalism. The trend of the Industrial Revolution in the West was falling prices, which spread an increased standard of living to every person; falling costs, which maintained general profitability of business; and stable monetary wage rates—which reflected steadily increasing real wages in terms of purchasing power. This is a process to be hailed and welcomed rather than to be stamped out.”

Be seeing you

Posted in Uncategorized | Tagged: inflation, Jason Furman, the Fed | Leave a Comment »

How Does The Fed Work? … Secretly

Posted by M. C. on June 12, 2023

Be seeing you

Posted in Uncategorized | Tagged: the Fed | Leave a Comment »

DeSantis and Trump diverge on The Fed, Big Government, and Bitcoin

Posted by M. C. on May 26, 2023

A generational gap reveals itself.

Notably, there is no more widely used tool for unlawful behavior than the U.S. Dollar, which is the preferred currency of terrorist organizations like ISIS.

Donald Trump and Ron DeSantis are ideologically aligned on most issues in their competition to win the Republican nomination for President of The United States. However, there are some key contrasts that provide a significant distinction between the two political rivals, and most of it has to do with the role of government in the economy.

Bitcoin

Ron DeSantis is unapologetically pro-Bitcoin and more broadly supports the rights of Americans to participate in a voluntary, market-based monetary system. In a Twitter Spaces Thursday evening, the Florida Governor made clear that he supports the use of bitcoin, and articulated why the Washington establishment disapproves of it. “I’ll protect the ability to do things like bitcoin,” he said, adding, “I don’t have an itch to control everything that people may be doing in this space.”

Moreover, Governor DeSantis has more broadly taken on the evolving digital space, drawing a distinction between distributed, decentralized assets like bitcoin, and government-backed tools for control and censorship. In Florida, he has implemented measures to forbid the use of any potential Central Bank Digital Currency (CBDC), warning that these tools can be used to implement a China-like Social Credit Score system in the United States. As governor, DeSantis has taken on the Davos ESG mafia, combatting the centralization of economic corporate and governmental power.

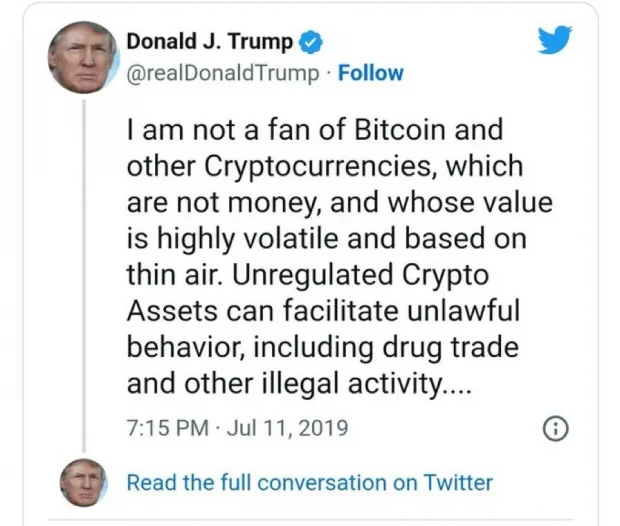

Trump, on the other hand, has long opposed bitcoin, claiming in a 2019 tweet that it is a tool of “unlawful behavior,” and that the government should take a more active role in regulating digital assets.

Notably, there is no more widely used tool for unlawful behavior than the U.S. Dollar, which is the preferred currency of terrorist organizations like ISIS.

In a 2021 in an interview with Fox News, Trump doubled down on his anti-bitcoin stance, declaring, “Bitcoin just seems like a scam. I don’t like it because it’s another currency competing against the dollar. I want the dollar to be the currency of the world; that’s what I’ve always said.”

President Trump has not publicly spoken about the potential threat posed by a CBDC or any other centralized monetary measures.

The Money Printer/The Fed

The former president has forwarded a convoluted message on monetary policy. On the one hand, he’s called for a return to the gold standard, and even, to his credit, tried to appoint the pro-gold standard Judy Shelton to the Federal Reserve Board. However, for most of his tenure as commander in chief, Trump was heavily in favor of unchecked monetary expansion and the growth of government as a whole.

Trump infamously encouraged Congress to authorize pandemic “emergency” spending of over 2 trillion dollars, and routinely proposed record budgets. These policies led to soaring inflation and the rapid debasement of Americans’ wealth. He ruthlessly attacked Rep Thomas Massie for opposing the money printing fiasco, and later supported an unsuccessful campaign to wage a primary battle against the Kentucky Republican.

For all his righteous condemnation of the “deep state” and the nefarious corporate agenda in politics, Trump’s policies acted to bolster the very forces he publicly opposes.

Be seeing you

Posted in Uncategorized | Tagged: Big Government, Bitcoin, DeSantis, the Fed, Trump | Leave a Comment »

The Fed Is a Purely Political Institution, and It’s Definitely Not a Bank. | Mises Wire

Posted by M. C. on January 18, 2023

But whatever its cause, the Fed’s current bankruptcy is simply the latest example of how the Fed is in no way a real bank or a private organization that funds itself through prudent self-management in the marketplace. Even worse, the Fed funds itself while in bankruptcy by printing money and inflating away the value of the dollars held by ordinary people. The Fed is just another tax-funded government agency, except that the tax that funds the Fed is the “inflation” tax,

https://mises.org/wire/fed-purely-political-institution-and-its-definitely-not-bank

Those who know Wall Street lore sometimes recall that Fed chairman William Miller—Paul Volcker’s immediate predecessor—joked that most Americans believed the Federal Reserve was either an Indian reservation, a wildlife preserve, or a brand of whiskey. The Fed, of course, is none of those things, but there’s also one other thing the Federal Reserve is not: an actual bank. It is simply a government agency that does bank-like things.

It’s easy to see why many people might think it is a bank. “Bank” is right there in the name of the twelve regional banks that make up the system: for example, the Federal Reserve Bank of Kansas City. The Fed also enjoys many titles that make it sound like a bank. It’s sometimes called the “lender of last resort.” Or it is sometimes called “a banker’s bank.” Moreover, many people often call the Fed “the central bank.” That phrase is useful enough, but not quite true.

Moreover, even critics of the bank often repeat the myth that the Federal Reserve is “a private bank,” as if that were the main problem with the Federal Reserve. And then there are the economists who like to spread fairy tales about how the Fed is “independent” from the political system and makes decisions based primarily on economic theory as interpreted by wise economists.

The de facto reality of the Federal Reserve is that it is a government agency, run by government technocrats, that enjoys the benefits of being subject to very little oversight from Congress. It is no more “private” than the Environmental Protection Agency, and it is no more a “bank” than the US Department of the Treasury.

It’s a Purely Political Institution

In its early decades, Congress and the Fed went to some pains to make the Fed look like a private organization that was self-funding, economically solvent, and subject to market forces.

For example, the Federal Reserve System was created—at least on paper—as a very decentralized organization. To this day, it has “shareholders,” which are the private “member” banks of the Federal Reserve. In the early years, the Federal Reserve System’s district banks operated fairly independently. Moreover, these shareholders were (and legally still are) supposed to incur losses when the Federal Reserve is in the red. Back in the days of the gold exchange standard, the Fed had gold reserves and its “banknotes” were supposed to be truly tied to those reserves in the banks. The Fed banks made revenue from discounting bills of exchange and from charging interest on government bonds. These relatively simple organizations were supposed to loan reserve funds to ensure banks had enough liquidity to remain solvent and help deal with financial crises.

The idea of ensuring Fed banks had real capital reserves made some sense when there was a domestic gold standard. But that all changed in a big way with the Great Depression. When Franklin Roosevelt ended the gold standard, the Federal Reserve Banks were forced to hand their gold over to the US Treasury. (To this day, the Fed has no gold.) Then came an enormous expansion of the regulatory state’s role in financial matters, and the Fed became a big part of this. Today, the Fed is far more a regulatory agency than it is any sort of “bank.”

It Monetizes Government Debt

Be seeing you

Posted in Uncategorized | Tagged: Federal Reserve, Government Debt, Monetize, the Fed | Leave a Comment »

Watch “Crack Up Boom? Has The Fed Lost Control Of Inflation?” on YouTube

Posted by M. C. on October 14, 2022

Markets always have the final say. They ultimately overrule the incessant schemes of politicians and central bankers. There are no man-made “policies” that have the capability of revoking economic laws. There are no shortcuts, loopholes, or free lunches. “Narratives” get squashed by the truth. Free Markets and Sound Money are the truth. We’d be wise to return to both of them.

Be seeing you

Posted in Uncategorized | Tagged: Crack Up Boom, inflation, the Fed | Leave a Comment »

Here Comes The Open Revolt: A Reeling Europe Lashes Out At The Fed For “Bringing Us To A World Recession”

Posted by M. C. on October 11, 2022

This time however, there is no simple solution taking advantage of gullible states, instead now that they’ve broken the seal of silence, the “leaders” of Europe admit to just how powerless they truly are when the custodian of the world’s reserve currency has to do what’s best only for itself, allies and friends be damned:

“Everybody has to follow, because otherwise their currency will be [devalued],” Borrell said to an audience of EU ambassadors, the FT reported. “Everybody is running to increase interest rates, this will bring us to a world recession.”

BY TYLER DURDEN

As a result of the Fed’s relentless tightening blitz, which on November 2 will have hiked rates by 75bps on four occasions in just 96 trading days, the fastest tightening campaign since Volcker, both US capital markets (the S&P 500 is down -24%, for the 4th worst year on record, only 1931, 1974, and 2002 were worse; and 10Y TSYs are down -17% for the worst year on record… 1987 second worse, and bonds were down -10%) and the US economy have been left reeling.

However, the damage in the US – whose economy is relatively isolated from the knock-on (or is that out) effects of the soaring global reserve currency – are nothing compared to the devastation unleashed by the Fed in the form of the soaring dollar and exploding interest rates. And yet the outcry against either the Soros Biden administration, or chair Powell has been relatively muted (excluding the occasional scathing oped in China’s Global Times and fake populist rage-tweet by everyone’s favorite “native American“, Liz Warren). To be sure, this was to be expected: after all, the last thing central banks need, when they are seeking to effect an extremely unpopular global economic recession that will leave millions without a job (think inflation is bad? just wait until you have no job and inflation is still bad) is growing discord among the ranks of the technocrats who have a simple script: no matter how unpopular or stupid a given policy is, you never, never, disagree in public, as this risks sparking popular outrage and toppling the entire house of cards at the hands of a suddenly very angry public.

At least that was the case until now: because today, in a startling outcry breaching the unspoken protocol of “no dissent, never dissent”, Josep Borrell, the high representative of the 27-member EU bloc, lashed out all too publicly at the Fed when he said that central banks (across Europe where the recession will be far, far worse than in the US) are being forced to follow the Fed’s multiple rate rises to prevent their currencies from slumping against the dollar, and compared the US central bank’s influence to Germany’s dominance of European monetary policy before the creation of the euro.

Be seeing you

Posted in Uncategorized | Tagged: Open Revolt, the Fed, World Recession | Leave a Comment »

The Fed’s “Full Employment” Mandate Is a Mandate for Inflation

Posted by M. C. on September 21, 2022

Over time, repeated referenced to “the dual mandate” were really just calls for continued activist monetary policy and even for the wildly experimental “unconventional monetary policy” employed after 2008.

https://mises.org/wire/feds-full-employment-mandate-mandate-inflation

In recent years, Congress has attempted to add various new mandates to the Federal Reserve’s mission. In 2020, Democrats introduced the “Federal Reserve Racial and Economic Equity Act.” Then, in 2021, pundits and politicians were telling us that it’s the Fed’s job to “combat climate change.” These are just the latest efforts to use the enormously powerful central bank to achieve political ends to the liking of elected officials.

This is a helpful reminder, of course, that the Fed is not independent from politics. The Federal Reserve has never been politically independent, and it certainly isn’t so now. Fed independence is a fairy tale academic economists like to tell their students. The debate over new mandates has also highlighted the fact the Fed already has no fewer than three mandates explicitly written into law: moderate long term interest rates, maximum employment, and stable prices.

In practice, however, the Fed has only two mandates because the Fed is so limited in what it can do to target long term interest rates in a global marketplace. This has led to what is now a de facto “dual mandate.”

This dual mandate is now all about maximizing employment while also maintaining “stable prices.” What this all means is never precisely spelled out in policy or law. It also changes over time. zero-percent CPI inflation was once the goal. Now the goal is the arbitrary two-percent standard. Similarly, what is meant by “maximum employment” is subject to the arbitrary definition of “full employment.”

In any case, it has been the view of central bankers for decades that one of the easiest ways to “maximize” employment is to embrace accommodative monetary policy. This, however, works counter to the mandate of stable prices by inflating the money supply. This leads to price inflation in the medium to long term.

So, the two mandates are essentially at odds. So which half of the mandate to focus on or emphasize? That’s up to the Fed.

In practice, however, experience suggests that the Fed tends strongly toward embracing the “maximum employment” side of the equation. Time and time again, central bankers have chosen to downplay the stable-prices mandate and embrace expansive monetary policy.

How the Fed Favors Maximum Employment

As a de facto instrument of the federal government, Federal Reserve policy tends to focus on what the federal government focuses on. So, the Fed was moved in the direction of greater focus on employment with the passage of the Employment Act of 1946. The Act stated:

The Congress hereby declares that it is the continuing policy and responsibility of the federal government to use all practicable means consistent with its needs and obligations and other essential considerations of national policy with the assistance and cooperation of industry, agriculture, labor, and state and local governments, to coordinate and utilize all its plans, functions, and resources for the purpose of creating and maintaining, in a manner calculated to foster and promote free and competitive enterprise and the general welfare, conditions under which there will be afforded useful employment for those able, willing, and seeking work, and to promote maximum employment, production, and purchasing power.

Although highly controversial at the time, the belief that the federal government ought to intervene to maximize employment—whether through fiscal or monetary policy—became well accepted over time. In terms of Fed policy following the adoption of the act, Allan Meltzer—author of a huge history of the Federal Reserve—concludes that “Interpretations of the 1946 Employment Act usually emphasized primacy of full employment.” In other words, the bias was in favor of easy money and intervention designed to stimulate the economy so as to ensure higher employment numbers.

Be seeing you

Posted in Uncategorized | Tagged: Full Employment, inflation, Mandate, the Fed | 1 Comment »

Student Loan Crisis: It Couldn’t Have Happened Without The Fed

Posted by M. C. on July 29, 2022

When government claims that it’s going to make something (anything) “more affordable” or “more accessible” … watch out! Their attempt to tilt the tables in a certain direction always backfires. It ends up ultimately hurting those who they intended to help. There are countless examples, but on today’s program, we discuss how the government (and Fed) created the student loan mess.

Be seeing you

Posted in Uncategorized | Tagged: Student Loan, the Fed | Leave a Comment »