When the Fed brags about it’s “tools” they amount to nothing but a plastic hammer. The Fed knows a massive correction (recession) is in the cards due to their easy money. They don’t have a clue as to how to remedy this situation.

The correction is the remedy.

The take away is bailout money is not going to you. Boeing, McDonnel Douglas, bankster cronies and boondoggles like solar panels, electric cars and politically correct social engineering projects will reap the benefit.

It is a bad sign that many companies previously bailed out are no longer viable. Think Obama’s electric car poster boy – Chevy Volt. Bankrupt solar panel and electric car battery companies.

The other item is no reserve banking. Until now banks had to keep something like 15% in reserve for people withdrawing savings.

That is now zero.

Theoretically a bank can now lend out every penny of customers savings leaving nothing for withdrawal.

https://www.lewrockwell.com/2020/04/gary-d-barnett/the-coronavirus-worm-has-turned-it-is-now-time-to-face-the-truth/

By Gary D. Barnett

“A society becomes totalitarian when its structure becomes flagrantly artificial: that is, when its ruling class has lost its function but succeeds in clinging to power by force or fraud.” ~ George Orwell (1956). “The Orwell Reader: Fiction, Essays, and Reportage”, New York : Harcourt, Brace

It is time for some hard truth that seems to escape nearly every American, but in reality, it is truth that is purposely hidden from view by the entirety of the mainstream. With this coronavirus fraud, the bigger picture is left in the shadows, and this of course is by design, and easy to accomplish in a country consumed by fear. The bigger picture that is only being addressed by a small number of people is the real elephant in the room, but virtually invisible to the masses. This is certainly due to deceit and corruption, but also is made so complicated as to assure that the common man does not understand it, and in fact will not pursue the real story behind this pandemic facade. These hidden enemies of all people and freedom are the Federal Reserve Banks and those controlling the monetary system.

If one travels back in time just a few years to the 2008 economic breakdown, many lessons could be learned, but apparently never were learned by those most adversely affected by such criminal behavior. During what should have been a collapse, banks and corporations, mostly those favored by the political class and the Federal Reserve, were all bailed out at the expense of the taxpayers. Actually, most everyone in this country was harmed except those favored players, but buying up the markets and claiming to save the country by printing money out of thin air has led to this current situation now in place. The economic debacle faced by all in this country today is not only far greater than what happened in 2008, but is not even comparable at any level. It is the equivalent of comparing a gentle rainstorm to a Category 5 hurricane.

Since the average person, and frankly most all others as well, ignore the workings of the Federal Reserve, it is time to expose what is actually going on with this criminal and scandalous private central banking system, and how this false flag called the Covid-19 pandemic is being used by the Fed to achieve agendas that will change the economic structure of this country and others forever. This is no accident, and it has nothing whatsoever to do with coronavirus, but that excuse is the impetus for restructuring the entire monetary system. A statement issued by the Federal Reserve through the Federal Open Market Committee on March 15th of this year stated that due to the coronavirus outbreak:

“The Federal Reserve is prepared to use its full range of tools to support the flow of credit to households and businesses and thereby promote its maximum employment and price stability goals.”

This surpasses propaganda, and is an outright lie with very sinister intent, as the Federal Reserve fully understands that increasing its balance sheet reserves has absolutely nothing to do with helping average people, households, or businesses in this country. Those reserves are not bank money, and cannot and will not ever be distributed to common people. In fact, all bank reserve requirements have been eliminated, so no reserves are now even necessary for banks to make loans. The entire process is a fraud, and is only meant to prop up the Fed so as to bail out its allies in crime in banking and corporate America, not those families being purposely destroyed due to a lie.

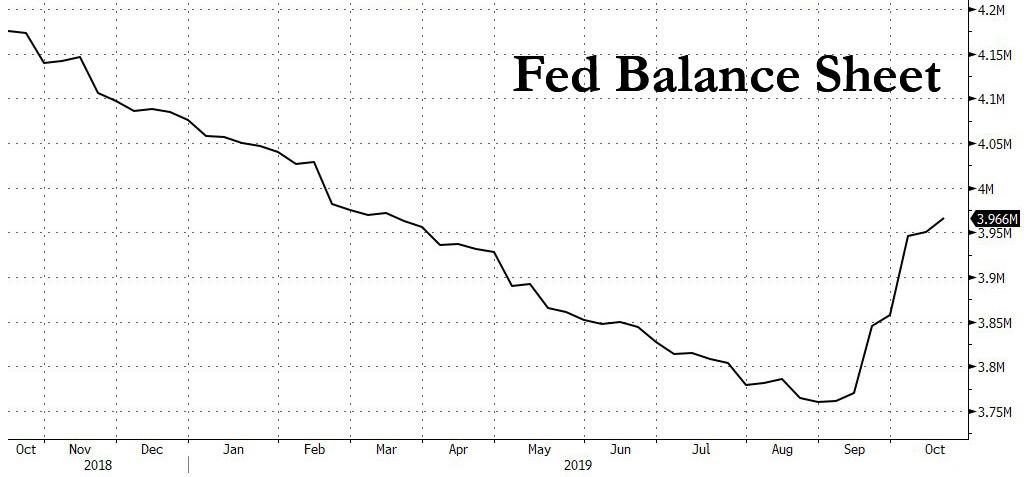

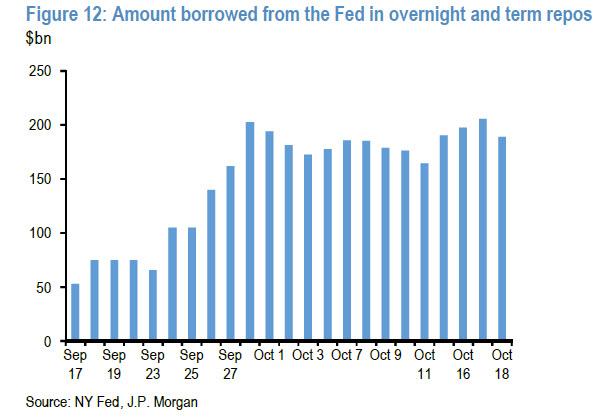

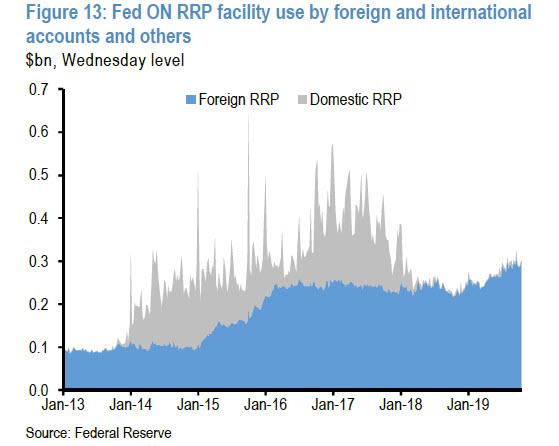

The U.S. economy has continued to worsen since the 2008 housing disaster and banking implosion, and has continued on its way to an imminent collapse. The Fed claims to be printing massive amounts of money and increasing its reserves due only to this coronavirus scare, but that is ludicrous and is also a flagrant lie. In September of last year, well before the so-called coronavirus pandemic was known, the Fed was in a dire position, and began dramatically increasing its balance sheet reserves and daily repurchase agreement (REPOs) “loans” to the banking sector, this in advance of any virus, not due to it. Massive Fed and banking problems began many years ago, and have worsened continuously, causing this economy to be on the edge of total failure. This has been known for a long time, so given the obvious lies, it is prudent to ask if this coronavirus was created as a cover for a failed economy. In my opinion, that is not only possible but also probable.

The 2 trillion dollar bailout also said to be for working Americans is also a lie, as only a few pennies on the dollar will ever get to working people. The bulk of all monetary distribution, and handouts will go to the inside accomplices at the top of the heap. Anyone paying attention should understand that all government is based on lies, deceit, corruption, and power growth, and the only way to achieve success in this atrocious venture is to retain tight control over the populace by striking fear in the hearts of all of society. Hence the coronavirus, which if purposely manufactured and introduced or not, is being used to accomplish agendas that are so far-reaching as to be nearly impossible to conceive. I lean heavily toward the side of this virus and the politics of fear being intentionally created, and that the panic and manipulation was due to a false pandemic, and not an accidental event. While this position will seem extreme to most, time will change that posture. The biggest world governance and monetary reset in history is coming soon due to this ruse.

The government that is telling you they are going to save you from a virus is the same government that is going to destroy your lives. That same government is expecting and leveling economic destruction on the country, and the Fed stated that unemployment just in this quarter alone would reach 32%, which equates to 47 million people out of work. Rocket science is not required to figure out the ramifications of this kind of unemployment tragedy. It is possible that before or during the third quarter of this year unemployment per capita could be double what it was at the height of the Great Depression. This is something that cannot be overcome by Fed policy or political interference, and in fact would signal an end to this economic system.

What will you do when the banks close? What will you do when you have no access to savings due to a monetary collapse? What will you do when riots, looting, and civil unrest are a normal part of your lives? What will you do when it is too late to do anything?

Keep in mind that the Fed balance sheet, money that will never be seen by any normal citizen, will most likely reach 10 trillion to 12 trillion dollars in the near future. Consider that regardless of any more coronavirus aid packages created by government, that little if any will reach or help the general population, but will go to government cronies. Consider that any and every “emergency” declared by government in the future will lead to in-house imprisonment, as has been openly admitted by the current administration officials. Consider the prospect of living in fear and isolation for life!

This is much more complicated and sinister than I can present here, but we are in the midst of a complete global restructuring of the monetary system, and one that will be devastating to all but those few with trillions in assets and in the most powerful positions. The rest of us will not only suffer, but will be left with poverty, despair, and death. This coming global reorganization, whether its finality is during this current “crisis” or not, is now inevitable in my opinion unless a very dramatic turnaround by the masses is forthcoming. Without a mass uprising against this tyranny, this nightmare will never end.

I cannot know exactly how this will turn out, but the writing on the wall would indicate that an abolishment of the world economic and monetary systems, and replacement with a new system is in the works. One thing is certain, if I am right about this, it was planned long ago, and all the pieces have been put into place to construct a new world economic order.

See this link to gain an understanding of current Fed fraud and of government corruption during this current crisis.

Also see these links here, here, here.

Be seeing you