Congress (both sides) spends it and the Fed prints it. Don’t believe a word either tells you.

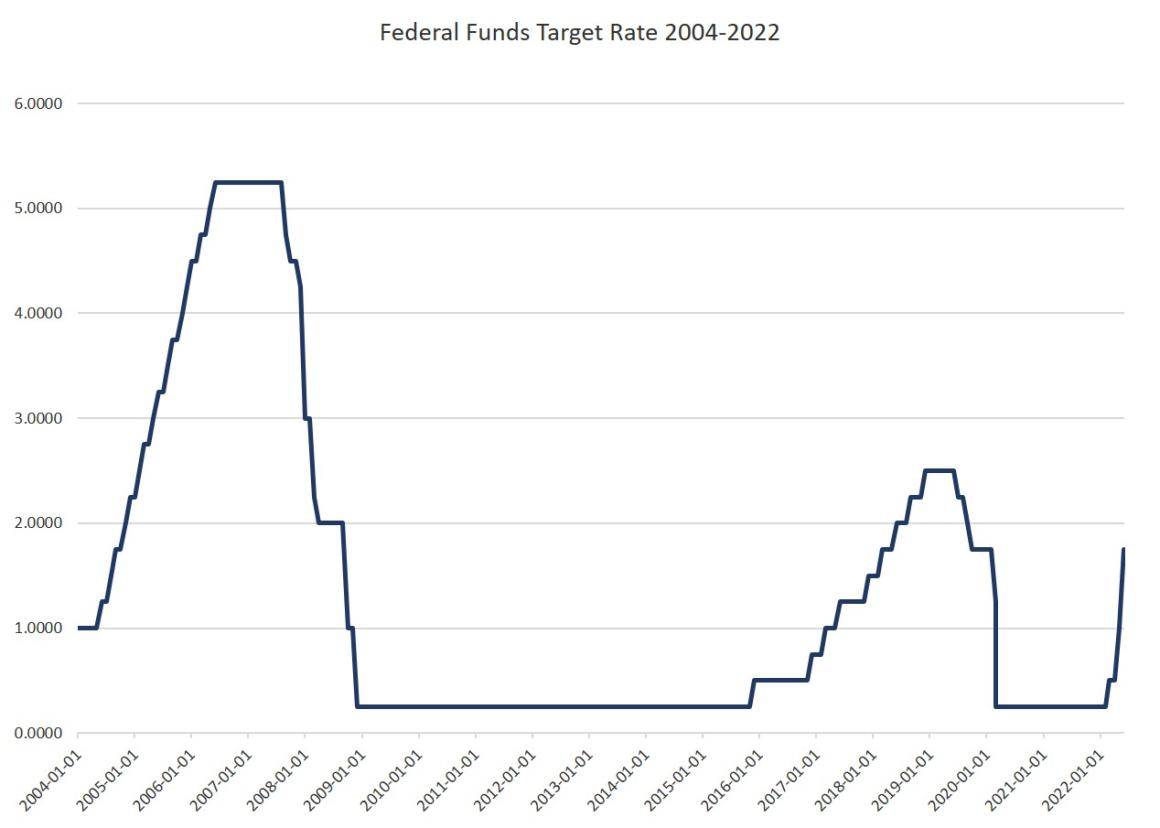

At its September 2024 meeting, the Fed’s FOMC cut the target federal funds rate by a historically large 50 basis points and then justified this cut on the grounds that “The Committee has gained greater confidence that inflation is moving sustainably toward 2 percent, and judges that the risks to achieving its employment and inflation goals are roughly in balance.”

The FOMC again cut the target rate in November and then again in December. Each time, the FOMC’s official statement said something to the effect of “[price] inflation is headed to two percent. Specifically, the November statement said “[Price inflation] has made progress toward the Committee’s 2 percent objective.” The December statement said exactly the same thing.

It remains unclear what motivated the FOMC to slice the target rate so drastically in September. Was it a cynical political ploy to stimulate the economy right before an election? Or was the Fed spooked by weak economic data? We don’t know, and the Fed is a secretive organization.

But whatever the Fed actually believes, the committee’s claims about “greater confidence” in falling price inflation is now gone. The FOMC announced in January that it would not lower the target rate, and the FOMC also removed from its official statement the line about making progress “toward the Committee’s 2 percent objective.” That sentence disappeared from the written statement, although Powell, in the press conference, apparently felt the need to remind the audience that “Inflation has moved much closer to our 2 percent longer-run goal…” He nonetheless failed to mention anything about continued progress.

It looks increasingly like all that confidence about “sustainable progress” on price inflation back in September—in the heat of election season, of course—was just one of the Fed’s many bogus, politically motivated forecasts.

Even if the Fed truly is motivated by the official data, though, it’s clear that the Fed now has good reason to downplay talk of declaring victory on the Fed’s two-percent inflation goal.

Recent official data—which generally reflects the best scenario that government bean counters can muster—shows plenty of bad news in this area. According to the Fed’s preferred inflation measure—PCE inflation—year-over-year price inflation reached an eight-month high in December, at 2.6 percent. (December is the most recent available number on PCE.) If we look at January’s headline CPI inflation, released on Wednesday, the picture is even worse. Year-over-year CPI inflation hit a nine-month high in January, at 3.0 percent, and month-to-month growth was at an eighteen-month high of 0.5 percent.

Thanks to the Fed’s unrestrained embrace of monetary inflation from 2020 to 2022, American consumers are still facing the grim reality of rising prices on basic necessities. In January’s CPI report, some of the largest jumps in prices were in food (2.5 percent), energy services (2.5 percent), other services (4.3 percent) and shelter (4.4 percent).

Wholesale prices also suggested that we won’t be seeing much relief from price inflation. According to new producer price index numbers, released on Thursday, year-over-year growth in the PPI reached a 24-month high of 3.5 percent. This is bad news for those hoping that the Fed’s predictions of falling prices might somehow come true. CNN delivered the bad news on Thursday: “The stronger numbers seen in Thursday’s PPI will tend to translate into continued consumer price inflation through the middle of the year.”

Be seeing you