https://www.lewrockwell.com/2019/11/no_author/syria-is-lost-lebanons-gold-is-next/

By Steve Brown

The largest reserve gold traders on the planet are the six bullion banks. A bullion bank is a large multi-national bank authorized to serve as a conduit through which Central Banks – and the Fed primary dealers – loan their gold out into the market. All central banks lease gold, to maintain their balance sheet and to provide sovereign collateral when a currency swap or paper trade won’t work. It’s called the gold carry trade.

There are currently six clearing banks on the LBMA handling gold lease transactions: Barclays, Scotia, Deutsche Bank, HSBC, JPM, and UBS all of which are primary Fed Dealer Banks, too. Central Banks need real money as collateral – physical gold holdings – to back paper (debt instruments) and as guarantor of foreign exchange sovereign liquidity, or when dealing with failed or semi-failed states.

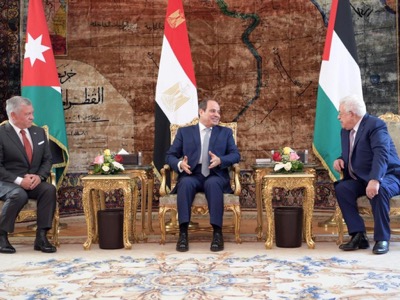

The Bullion Banks not only guarantee and lease their own gold reserves, but require adjustments to physical gold holdings based on Geopolitical events particularly during times of war. For example, Libya, Afghanistan, Iraq, Syria, Egypt and the Ukraine have all turned over their physical gold holdings to the IMF – which acts by proxy for the Fed and G7 Central Banks – for favorable lending terms or settlement of debt to the West, or their gold is seized by force of arms.

Nixon officially closed the US international sovereign gold trading window in 1971, alleged to be temporary, now ostensibly never to re-open. Officially Nixon’s gold closure still applies to US gold trading, but the “official” world is not the real world. Thus, the US engages in covert gold trading shrouded in secrecy, generally by proxy to the IMF and via gold carry trade gold swaps. (Also see: IMF voting rights and reform and the Exchange Stabilization Fund)

The international gold window is not about a “gold standard” but about international trade in gold. That trade is to support currency swaps to manipulate currency markets; to enhance interest returns by leveraging other debt products providing a higher return; or to build or deplete foreign exchange reserves held by a sovereign or Central Bank. Thus, the international gold window still exists in the form of the gold carry trade.

But the international gold window is much more than a trade and collateral window, the international gold window is still an essential factor in Geo-politics. Conflicts and alliances require the gold carry trade to operate by covert, by proxy, or by overt means. The gold carry trade market also operates by acquiring the gold reserves of failed states such as Iraq, Libya, Syria, Afghanistan, or Ukraine, at prices subsidized by the US taxpayer.

Or the cost of their lost treasure is borne by the unknowing, unaware local population partaking in a “colour revolution” or the “Arab Spring” for example, on behalf of Washington.

The banking crisis in Lebanon is one recent example, where geopolitics and finance – especially relating to gold – intersect. Lebanon has relatively high physical gold reserves relative to its economy and relative to other Middle Eastern states, and Lebanon has been a player in the carry trade for many years.

However, according to one confidential source and many reports, Lebanon has dialed-back its carry trade activities since 2015. By scaling back its carry trade activity, Lebanon has provoked the ire of western Central Banks, and made it more difficult for Lebanon to protect its currency.

The reason for Lebanon’s de-leveraging in the gold carry trade is unknown, but one can only speculate that along with US sanctions versus Lebanon, the international currency cartel has its eye on Lebanon’s gold reserves. By extension, The Neocon-Neoliberal ‘Blob’ believes that by harming Lebanon, the Blob can likewise curtail Hezbollah’s influence.

Israel too, currently subject to its own self-induced purgatory in leadership, desperately needs a visible geopolitical victory, and no doubt US and Israeli central bankers see Lebanon’s finance as low-hanging fruit, since Hezbollah cannot be militarily defeated. How do we know? …well, David Ignatius tells us so…

Germany

Germany demanded return of its gold reserves from New York (called repatriation). In reality repatriation ends the lease conditions by which the Federal Reserve holds German gold. That Germany leased approximately 300 tonnes of gold to the US Exchange Stabilization Fund during the US financial collapse is well known, and the ESF undoubtedly disposed of that German gold by carry trade means, to support the US dollar and stock market. Effectively the US government may sell or lease any “commodity” as it sees fit, in its possession, whether strategic oil reserves or gold – even if that gold “belongs” to a foreign power…

Ukraine

Long a hotbed of corruption, shady dealings, and political intrigue, the Ukraine has leveraged its gold reserves via the carry trade and leasing system for many years now. Falling prey to the IMF predatory system of capital is another Ukraine specialty, since Ukraine’s gold is its only real strategic asset, besides it location adjacent to Eastern Europe…

Argentina

Likewise, the IMF was the worst possible option for Argentina. Argentina was forced to sell 1/3rd of its physical gold reserves from 2009-2013, to prevent a replay of 2001 by placating US bond holders. Argentina’s gold reserves played a major role in keeping the country somewhat liquid, but now western powers want the rest of that gold – represented by bondholder lawsuits – since Argentina just defaulted again.

Netherlands

In 2014 the Dutch Central bank announced that 122 metric tonnes of gold had been repatriated from the United States. The DCB’s loss of confidence in the US likely relates to the collapse of the US financial system from 2008-2009. It’s likely too that the Netherlands loaned some sovereign gold reserves to the Fed/ESF during that crisis, and has not seen its gold returned.

Venezuela

Half of Venezuela’s reserves are in gold. The structural and fundamental problem is that Venezuela cannot lease gold via the bullion banks because the physical gold was repatriated, and the gold still present in US /London vaults is sanctioned…

Summary

Trouble is, most of the third world and Non-Aligned Movement – with the exception of Iran, Lebanon, and Venezuela – have already turned over their gold to the West. So, there is little physical gold for Washington to cajole, appropriate, or steal from destabilized sovereign entities or failed states Washington creates…

Be seeing you