And while firms are reducing the quantity and quality of the food they sell, consumers are also choosing to purchase less food and even lower-quality food. The January 2023 report on consumer inflation sentiment shows that 69.4 percent of respondents “reduced quantity, quality or both in their grocery purchases due to price increases over the last 12 months.”

https://mises.org/wire/shrinkflation-and-skimpflation-are-eating-our-lunch

Economist Jeremy Horpedahl dismissed the silly claim by anticapitalists that capitalism must engineer food scarcity for the sake of profits. He presented a graph of Bureau of Labor Statistics (BLS) data demonstrating a substantial decrease in household food expenditure as a percentage of income—from 44 percent in 1901 to a mere 9 percent in 2021. This is something to celebrate and certainly can be attributed to the abundance of market economies.

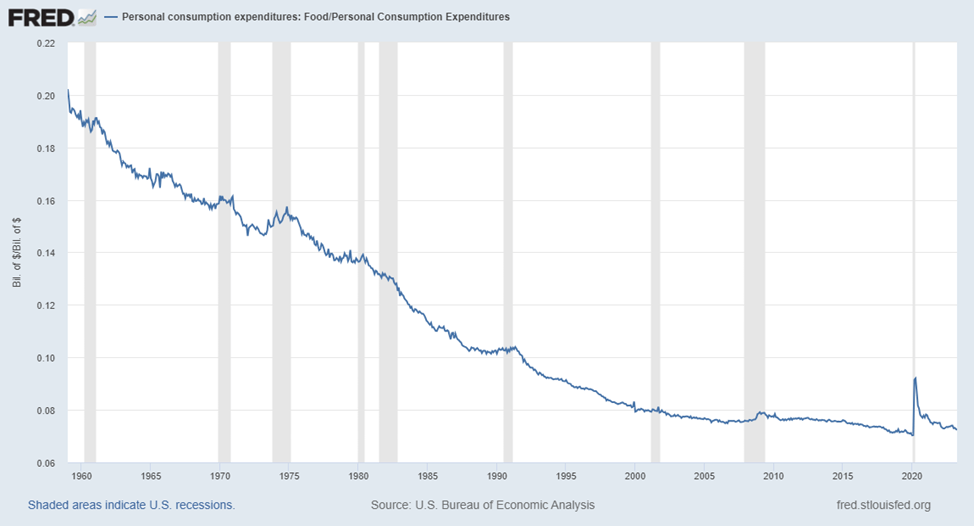

But when Jordan Peterson asked, “And what’s happened the last two years?” I went digging. First, I confirmed Horpedahl’s observation: the amount we spend on food as a proportion of our budget has fallen dramatically. Second, I saw what Peterson hinted at: a significant spike in food spending when covid and the associated mess of government interventions hit (figure 1).

Figure 1: Food and personal consumption expenditures, 1959–2023

Source: US Bureau of Economic Analysis, FRED.

Interestingly, the spike looks like a blip. Someone oblivious to the events of the past few years might see this chart and say, “Yeah, something strange happened in 2020, but it looks like everything is back to normal.” I’m certain that this doesn’t align with anyone’s experience, however. Even today, no one would say that restaurant visits and grocery store trips cost the same as they did in 2019.

What changed in 2020? Why does this graph not feel right? Assuming the Bureau of Economic Analysis data isn’t totally off (and it is important to be skeptical of government data), why would a January 2023 report on consumer inflation sentiment conclude that “there is a disconnect between the inflation data reported by the government and what consumers say they now pay for necessities”?

The difference lies in the qualitative aspects of our experience as consumers. Spending proportions may have returned to their trend, but that isn’t the whole story. “Shrinkflation” and “skimpflation” have taken their toll on the quantity and quality of the food we enjoy—or maybe the food we tolerate is more apt.

Businesses know that charging higher prices is unpopular, especially when many consumers are convinced that greed is driving price inflation. So businesses resort to reducing the amount of food in the package, diluting the product but keeping the same amount, or otherwise cutting corners in ways that consumers may not immediately notice.

Thankfully, websites such as mouseprint.org document some of these cases:

Be seeing you