Remember Gates?

Be seeing you

Posted by M. C. on January 2, 2025

Posted in Uncategorized | Tagged: debt, President Musk, the left, The Right | Leave a Comment »

Posted by M. C. on November 1, 2023

The favored Counterculture alternative was to own your own work, own your own tools and own your own land. And by “own” we mean “own free and clear,” i.e. zero debt.

https://www.oftwominds.com/blogoct23/counterculture10-23.html

Charles Hugh Smith

Rather than mocking the Counterculture, we would benefit from re-acquiring its values that favored frugality and the ownership of skills, work, enterprise and land.

Mention the Counterculture of the 1960s and 1970s, and the memory stored in popular culture is of drug-dazed, half-naked hippies dancing to rock music. There was a slice of that, to be sure, but there was much more that’s largely been forgotten:

The Counterculture was primarily a response to the meaningless debt-dependent consumerism that had already taken hold of our society and economy. The core values of the Counterculture Everyone Forgot were:

1. Learning how to make and repair things oneself

2. Frugality

3. Rejection of debt

I submit that the value of these life precepts will become increasingly visible and necessary. As I’ve explained before, reliance on debt incentivizes the most destructive and unsustainable traits of human nature: choosing the painless, sacrifice-free option of pushing costs into the future, the removal of any incentive to become more productive and efficient, and the optimization of the illusion that the future will painlessly be able to not just service the current mountain of debt but an entire mountain range of debt that will pile up as our borrowing increases.

The emptiness and meaningless of consumerism has reached levels which are now actively destroying our health, as I laid out in gory detail in The Profitable Destruction of Americans’ Health. The optimization of maximizing profit via monopoly/cartel profiteering, planned obsolescence and shrinflation (getting less while paying more) has stripped products and services of durability, so everything we buy is on a conveyor belt to the Landfill–the perfection of our Waste Is Growth Landfill Economy.

This conveyor belt of squandered wealth looks sustainable as long as debt can skyrocket at near-zero rates of interest. But those days are gone, never to return. Borrowing more money now costs money, and so long after the unrepairable, low-quality gew-gaw is rotting away in the landfill, the debt used to purchase it lives on, eating the borrower alive.

The secular bible of the Counterculture was the Whole Earth Catalog, a collection of quality American-manufactured tools and products designed for durability and productive use. In other words, things that aren’t consumed, they’re used to generate value. This concept has largely been lost: human beings are not productive beings, we’re consumers, whose very identity anf existence flows from buying more of everything: I shop, therefore I am.

The depravity of borrowing money to squander on things of questionable or temporary value was visible 60 years ago, and the depravity will soon consume all those who believe this system is sustainable. What’s the opposite of a depraved dependence on debt to buy stuff of questionable or temporary value? Buying tools with cash and learning how to use them to create value for oneself, one’s household and one’s community, and consume / share / sell what one produces.

The Counterculture questioned the value of debt and consumerism, and sought to return to the bedrock skills and values of the pre-debt/consumerism era. These included frugality–waste not, want not–in service of saving up and paying cash for everything rather than borrowing money, and in reducing dependence on the exploitive system of labor, where one sells their time (i.e. their life) for the dubious benefits of a wage.

The favored Counterculture alternative was to own your own work, own your own tools and own your own land. And by “own” we mean “own free and clear,” i.e. zero debt.

One of the more popular books of the Counterculture era was How to Live on Nothing (1/1/71), an exaggeration of course, but nonetheless it offered a practical guide to spending as little as possible, for it was understood that frugality equals freedom and debt equals servitude.

Be seeing you

Posted in Uncategorized | Tagged: consumerism, Counterculture, debt, Frugality | Leave a Comment »

Posted by M. C. on October 4, 2023

Be seeing you

Posted in Uncategorized | Tagged: Continuing Resolution, debt | Leave a Comment »

Posted by M. C. on May 31, 2023

Sen. Rand Paul (R-KY) echoed Lee’s tweet, writing: “Fake conservatives agree to fake spending cuts. Deal will increase mandatory spending ~5%, increase military spending ~3%, and maintain current non-military discretionary spending at post-COVID levels. No real cuts to see here. Conservatives have been sold out once again!”

Many top conservatives slammed the bipartisan agreement reached between President Joe Biden and House Speaker Kevin McCarthy over the weekend that is expected to prevent the U.S. from defaulting on its debt.

While the details of the agreement are still being ironed out, and congressional leaders still have to convince their Members to vote for it, some on the top Republicans in Washington, D.C., are not happy with the agreement.

“There are members of the GOP claiming Democrats got nothing from the ‘deal.’ Oh really? 1) An uncapped debt ceiling with an expiration date – worth approximately $4 trillion…? 2) basically no cuts – a freeze at bloated 2023 spending level?” Rep. Chip Roy (R-TX), a House Freedom Caucus member, tweeted. “ZERO claw back of the $1.2 Trillion ‘inflation reduction act’ crony giveaways to elite leftists for grid-destroying unreliable energy…? 4) 98% of the IRS expansion left fully in place…? 5) no work requirements for Medicaid? – & only age adjustments for TANF/SNAP…?”

“No REINS act statutory requirement for congress to approve huge regulations – just an ‘administrative’ paygo that the administration will get to enforce? 7) No border security!! – & a deal allowing them to avoid policy riders in the fall… 8) more…” he added.

Sen. Mike Lee (R-UT) responded, “With Republicans like these, who needs Democrats?”

Be seeing you

Posted in Uncategorized | Tagged: debt, Default, Kevin McCarthy, McCarthy-Biden, REINS Act | Leave a Comment »

Posted by M. C. on February 22, 2021

Inflation and growth are not low due to excess savings, but because of excess debt, which perpetuates overcapacity with low rates and high liquidity and zombifies the economy by subsidizing the low-productivity and highly indebted sectors and penalizing high productivity with rising and confiscatory taxation.

https://libertarianinstitute.org/articles/prepare-for-negative-interest-rates/

Negative rates are the destruction of money, an economic aberration based on the mistakes of many central banks and some of their economists, who all start from a wrong diagnosis: the idea that economic agents do not take more credit or invest more because they choose to save too much and therefore saving must be penalized to stimulate the economy. Excuse the bluntness, but it is a ludicrous idea.

Inflation and growth are not low due to excess savings, but because of excess debt, which perpetuates overcapacity with low rates and high liquidity and zombifies the economy by subsidizing the low-productivity and highly indebted sectors and penalizing high productivity with rising and confiscatory taxation.

Historical evidence of negative rates shows that they do not help reduce debt, they incentivize it. They do not strengthen the credit capacity of families: the prices of nonreplicable assets (real estate, etc.) skyrocket because of monetary excess and because the lower cost of debt does not compensate for the greater risk.

Investment and credit growth are not subdued because economic agents are ignorant or saving too much, but because they don’t have amnesia. Families and businesses are more cautious in their investment and spending decisions, because they perceive, correctly, that the reality of the economy they see each day does not correspond to the cost and the quantity of money.

It is completely incorrect to think that families and businesses are not investing or spending. They are only spending less than what central planners would want. However, that is not a mistake from the private sector side, but a typical case of central planners’ misguided estimates, which come from using 2001–07 as “base case” of investment and credit demand instead of what those years really were: a bubble.

The argument of the central planners is based on an inconsistency: that rates are negative because markets demand them, not because they are imposed by the central bank. If that is the case and the result would be the same, why don’t they let rates float freely? Because it is false.

Think for a moment what type of investment, company, or financial decision is profitable with rates at –0.5 percent but unviable with rates at 1 percent. A time bomb. It is no surprise that investment in bubble-prone sectors is rising with negative rates and that nonreplicable and financial assets are skyrocketing.

Instead of strengthening economies, negative rates make governments more dependent on cheap debt. Public debt trades at artificially low yields, and politicians abandon any reformist impulse, preferring to accumulate more debt.

The financial repression of central banks begins with a misdiagnosis assuming that low growth and below-target inflation is a problem of demand, not of the previous excess, and ends up perpetuating the bubbles that it sought to solve.

The policy of negative types can only be defended by people who have never invested or created a job, because no one who has worked in the real economy can believe that financial repression will lead economic agents to take much more credit and strengthen the economy.

Negative rates are a huge transfer of wealth from savers and real wages to the government and the indebted. A tax on caution. The destruction of the perception of risk that always benefits the most reckless. It is a bailout of the inefficient.

Central banks ignore the effects of demography, technology, and competition on inflation and growth of consumption, credit, and investment, and with the wrong policies generate new bubbles that become more dangerous than the previous ones. The next bubble will again increase countries’ fiscal imbalances. Even worse, when central banks present themselves as the agents that will reverse the effect of technology and demographics, they create a greater risk and bubble.

When this happens, it becomes necessary for to protect one’s savings with gold, silver, inflation-linked instruments, and stocks in sectors that do not suffer from negative rates.

This article was originally featured at the Ludwig von Mises Institute

Be seeing you

Posted in Uncategorized | Tagged: Central Banks, debt, inflation, Negative Interest Rate | Leave a Comment »

Posted by M. C. on January 16, 2021

https://goldswitzerland.com/bidens-banana-republic/

By Egon von Greyerz

Donald Trump is probably the luckiest presidential candidate in history to have lost an election. He doesn’t realise it yet as he suffers from a self-inflicted wound in the final moments of his presidency. Nor does Biden yet realise how unlucky he is to have won. But that will soon change as his presidency goes from crisis to crisis in all areas from monetary to fiscal to social and political. Very little will go right during his presidency.

The next four years could easily be four years of hell for Biden (if he stays the course for the whole four years), for the US and thus for the world.

When Trump won the election in November 2016 I wrote an article, dated Nov 18, 2016, called “Trump Will Grow US Debt Exponentially” .

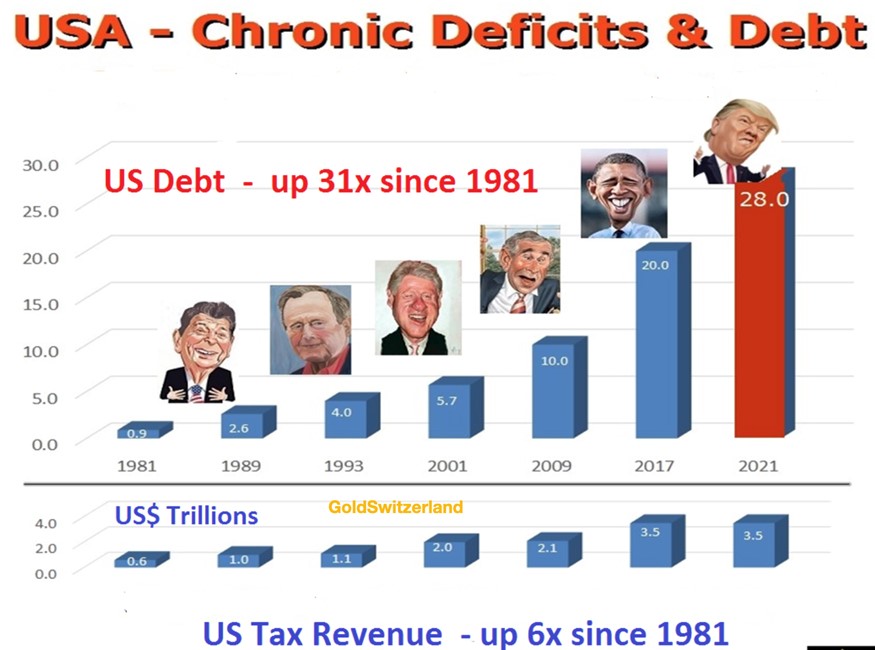

The article also contained the following graph. In the article I predicted that US debt would double by 2025 to $40 trillion and that it would be $28t in January 2021 at the end of the four years.

Well, surprise, surprise, the debt is today $27.77t which can easily be rounded up to $28t.

I am certainly no forecasting genius, nor was the forecast just luck.

No, it was applying the best method that we have all been given but that few apply or understand.

This method is called HISTORY.

US debt had on average doubled every 8 years since Reagan took over in 1981. So as Trump became president in Jan 2017, he inherited a debt of $20t. Easy then to forecast that 8 years later the debt would be $40t. The $28t forecast for Jan 2021 is just the mathematical in-between point between $20t and $40t.

Even worse than the debt explosion is the the lack of tax revenue to finance the escalating and chronic budget deficits. As the graph above shows, debt has grown 31x since 1981 whilst tax revenues have only grown 6x.

The US deficit is currently $3.3t which is virtually equal to total tax revenue of $3.4t. This means that 50% of annual government spending needs to be borrowed.

The US economy now clearly fits the definition of a Banana republic. A brief description is: “In political science, the term banana republic describes a politically unstable country with an economy dependent upon the exportation of a limited-resource product, such as bananas or minerals.”

In the case of the US, the product they export is of course dollars printed out of thin air – a wonderful export item since supply is unlimited.

Further description is: “Typically, a banana republic has a society of extremely stratified social classes, usually a large impoverished working class and a ruling class plutocracy, composed of the business, political, and military elites of that society.”

Like all Banana Republics, the US economy and social structure is now on the way to perdition with virtually nil chance for Biden & Co to reverse the inevitable course of events.

So back to history – History is what has formed us and history doesn’t just rhyme as Mark Twain said but it often repeats itself. The debt explosion is another good example.

If more people studied and understood history, they would not just recognise the utmost importance of what lies behind us but also that history will teach us about what lies in front of us.

But very few scholars and no journalists study history. Instead we are now in an era when both the media and universities worldwide want to erase history and rewrite the history books. This shows us the total lack of understanding of the utmost importance of history in the evolution of the world.

But this is part of the total decadence and denial that we see at the end of major eras or cycles. The current cycle, whether it is just a 300 year cycle or a 2,000 year old cycle is now coming to an end. These changes clearly don’t happen overnight but the first phase of the fall can be dramatic. And that phase is likely to be starting very soon.

So what will Biden and his masters do? Well Biden has already called for $ trillions of further support.

He also said: “If we don’t act now, things are going to get much worse and harder to get out of a hole later.”

Well we always knew that Biden really only had one trick up his sleeve – TO PRINT MORE than any president has done in history. To beat Trump is not hard, he only printed $8t in 4 years!

Let’s just remind ourselves that it took 200 years (1808-2008) to increase the US debt from $65 million to $10 trillion.

When Obama took over in Jan 2009 he inherited a $8t debt. Eight years later he handed over a $20t batten to Trump.

In 8 years Obama printed and borrowed more money than the previous presidents had achieved in the course of 200 years!

So will Biden print more than $10t?

Definitely!

Will he do it in 4 years? Most probably!

As I forecasted in my article in 2016, the debt will be at least $40t in Jan 2025, a $12t increase from today.

But no one should believe that Biden will stop at $40t. The US economy is already leaking like a sieve. And the problems have just started.

The problems in the currently semi-paralysed US economy will escalate at a rapid rate and the Biden team will attempt to plug every hole at all levels from a minimum wage to saving major corporations.

But sadly, Banana Republics don’t survive by printing worthless money.

Still, we mustn’t forget what started the latest phase of problems in the US economy.

It wasn’t Covid back in February 2020. No, that was a mere catalyst. The underlying disaster was a lot deeper. The real problem started back in Aug-Sep 2019. This is when the problems in the financial system became acute and both the ECB and Fed started flooding the system with money. But not real money of course but just worthless paper money created with just pushing a button.

Between the Fed and the ECB just under $8t of “fake” money has been created digitally since Sep 2019. It must obviously be called fake since nobody had to perform any work or produce any goods or services against this money.

It is really scandalous to call it money since it is no different from the Monopoly game money.

The printed $8 trillion at $15 per hour (Biden’s new minimum wage) equals 60 million man hours. But in the modern MMT (Money Market Theory) paradigm, you don’t need to work for the money. Whatever the world needs, central banks and governments can just create out of nothing.

That is until the music stops. And Biden or Harris are the likely conductors who will preside over the music stopping and the whole edifice collapsing.

The wise will obviously find a chair already now because when the music stops there will be no chairs free and all hell will break loose.

By that time debt will not just be in the $trillions or $100s of trillions. No, the printing will have reached $ and EUR quadrillions as not only most collapsing debt will need to be bought by central banks but also derivatives which probably amount to $2 quadrillion or more.

In addition, medical care, social security and unfunded pensions will probably exceed $1 quadrillion globally and add to the demise of the financial system.

Could I be wrong. Maybe. A close friend gave me once a T-shirt with the inscription:

“I AM NOT ALWAYS RIGHT – But I am never wrong”!

The gift must have been a subtle hint – Hmmm

Still, in my humble view I don’t believe that any orderly reset will change the inevitable course of events. So as far as I am concerned, it is not IF but WHEN.

A professional life of over half a century has taught me that even the most evident events can take longer to develop than you think.

But as I see risk at an extreme, now is the time to prepare.

So to finish, let’s have a quick look at where I see markets. I know forecasting is a mug’s game and I am not really interested in how markets move in the short term more than from an observational point of view.

In the next few years it is all about economic survival and wealth preservation rather than worrying about where the Dow or the Dax is going next.

See the rest here

Be seeing you

Posted in Uncategorized | Tagged: $ trillions, banana republic, Biden, debt, ECB, Fed | Leave a Comment »

Posted by M. C. on August 20, 2020

It’s most unfortunate, but the U.S. and its allies will turn into authoritarian police states. Even more than they are today. Much more, actually. They’ll all be perfectly fascist – private ownership of both consumer goods and the means of production topped by state control of both. Fascism operates free of underlying principles or philosophy; it’s totally the whim of the people in control, and they’ll prove ever more ruthless.

https://internationalman.com/articles/how-fascism-comes-to-america/

by Doug Casey

I think there are really only two good reasons for having a significant amount of money: To maintain a high standard of living and to ensure your personal freedom.

There are other, lesser reasons, of course, including: to prove you can do it, to compensate for failings in other things, to impress others, to leave a legacy, to help perpetuate your genes, or maybe because you just can’t think of something better to do with your time.

But I’ll put aside those lesser motives, which I tend to view as psychological foibles.

Basically, money gives you the freedom to do what you’d like – and when, how, and with whom you prefer to do it. Money allows you to have things and do things and can even assist you to be something you want to be. Unfortunately, money is a chimera in today’s world and will wind up savaging billions in the years to come.

As you know, I believe we’re well into what I call The Greater Depression. A lot of people believe we’re in a recovery now; I think, from a long-term point of view, that is total nonsense. It will be far more severe than what we saw in 2008 and 2009 and will last quite a while – perhaps for many years, depending on how stupidly the government acts.

There are reasons for optimism, of course, and at least two of them make sense.

The first is that every individual wants to improve his economic status. Many (but by no means all) of them will intuit that the surest way to do so is to produce more than they consume and save the difference. That creates capital, which can be invested in or loaned to productive enterprises. But what if outside forces make that impossible, or at least much harder than it should be?

The second reason for optimism is the development of technology – which is the ability to manipulate the material world to suit our desires. Scientists and engineers develop technology, and that also adds to the supply of capital. The more complex technology becomes, the more outside capital is required. But what if sufficient capital isn’t generated by individuals and businesses to fund further technological advances?

There are no guarantees in life.

Throughout the first several hundred thousand years of human existence, very little capital was accumulated – perhaps a few skins or arrowheads passed on to the next generation. And there was very little improvement in technology – it was many millennia between the taming of fire and, say, the invention of the bow.

Things very gradually accelerated and improved, in a start-stop-start kind of way – the classical world, followed by the Dark Ages, followed by the medieval world. Finally, as we entered the industrial world 200 years ago, it looked like we were on an accelerating path to the stars. All of a sudden, life was no longer necessarily so solitary, poor, nasty, brutish, or short. I’m reasonably confident things will continue improving, possibly at an accelerating rate. But only if individuals create more capital than they consume and if enough of that capital is directed towards productive technology.

Those are the two mainsprings of human progress: capital accumulation and technology.

Unfortunately, however, that reality has become obscured by a morass of false and destructive theories, abetted by a world that’s become so complex that it’s too difficult for most people to sort out cause and effect. Furthermore, most people in the OECD world have become so accustomed to good times, since the end of WW2, that they think prosperity is automatic and a permanent feature of the cosmic firmament. So although I’m very optimistic, progress – certainly over the near term – isn’t guaranteed.

These are the main reasons why the standard of living has been artificially high in the advanced world, but don’t confuse them with the two reasons for long-term prosperity.

The first is debt. There’s nothing wrong with debt in itself; lending is one way for the owner of capital to deploy it. But if a society is going to advance, debt should be largely for productive purposes, so that it’s self-liquidating; and most of it would necessarily be short term.

But most of the scores of trillions of debt in the world today are for consumption, not production. And the debt is not only not self-liquidating, it’s compounding. And most of it is long term, with no relation to any specific asset. A lender can reasonably predict the value of a short-term loan, but debt payable in 30 years is impossible to value realistically.

All government debt, mortgage debt, consumer debt, and almost all student loan debt does nothing but allow borrowers to live off the capital others have accumulated. It turns the debtors into indentured servants for the indefinite future. The entire world has basically overlooked this, along with most other tenets of sound economics.

The second is inflation. Like debt, inflation induces people to live above their means, but its consequences are even worse, because they’re indirect and delayed.

If the central bank deposited $10,000 in everyone’s bank account next Monday, everyone would think they were wealthier and start consuming more. This would start a business cycle. The business cycle is always the result of currency inflation, no matter how subtle or mild. And it always results in a depression. The longer an inflation goes on, the more ingrained the distortions and misallocations of capital become, and the worse the resulting depression.

We’ve had a number of inflationary cycles since the end of the last depression in 1948. I believe we’re now at the end of what might be called a super-cycle, resulting in a super-depression.

The third is the export of dollars. This is unique to the U.S. and is the reason the depression in the U.S. will in some ways be worse than most other places. Since the early ’70s, the dollar has been used the way gold once was – it’s the world’s currency. The problem is that the U.S. has exported perhaps $10 trillion – but nobody knows – in exchange for good things from around the world. It was a great trade for a while. The foreigners get paper created at essentially zero cost, while Americans live high on the hog with the goodies those dollars buy.

But at some point quite soon, dollars won’t be readily accepted, and smart foreigners will start dumping their dollars, passing the Old Maid card. Ultimately, most of the dollars will come back to the U.S., to be traded for titles to land and businesses. Americans will find that they traded their birthright for a storage unit full of TVs and assorted tchotchkes. But many foreigners will also be stuck with dollars and suffer a huge loss. It’s actually a game with no winner.

These last three factors have enabled essentially the whole world to live above its means for decades. The process has been actively facilitated by governments everywhere. People like living above their means, and governments prefer to see the masses sated.

The debt and inflation have also financed the growth of the welfare state, making a large percentage of the masses dependent, even while they’ve also resulted in an immense expansion in the size and power of the state over the last 60-odd years. The masses have come to think government is a magical entity that can do almost anything, including kiss the economy and make it better when the going gets tough. The type of people who are drawn to the government are eager to make the state a panacea. So they’ll redouble their efforts in the fiscal and monetary areas I’ve described above, albeit with increasingly disastrous results.

They’ll also become quite aggressive with regulations (on what you can do and say, and where your money can go) and taxes (much higher existing taxes and lots of new ones, like a national VAT and a wealth tax). And since nobody wants to take the blame for problems, they’ll blame things on foreigners. Fortunately (the U.S. will think) they have a huge military and will employ it promiscuously. So the already bankrupt nations of NATO will dig the hole deeper with some serious – but distracting – new wars.

It’s most unfortunate, but the U.S. and its allies will turn into authoritarian police states. Even more than they are today. Much more, actually. They’ll all be perfectly fascist – private ownership of both consumer goods and the means of production topped by state control of both. Fascism operates free of underlying principles or philosophy; it’s totally the whim of the people in control, and they’ll prove ever more ruthless.

So where does that leave us, as far as accumulating more wealth than the average guy is concerned?

I’d say it puts us in a rather troubling position. The general standard of living is going to collapse, as will your personal freedom. And if you’re an upper-middle-class person (I suspect that includes most who are now reading this), you will be considered among the rich who are somehow (this is actually a complex subject worthy of discussion) responsible for the bad times and therefore liable to be eaten. The bottom line is that if you value your money and your freedom, you’ll take action.

There’s much, much more to be said on all this. I’ve said a lot on the topic over the past few years, at some length. But I thought it best to be brief here, for the purpose of emphasis. Essentially, act now, because the world’s combined economic, financial, political, social, and military situation is as good as it will be for many years… and a lot better than it has any right to be.

One more thing: Don’t worry too much.

All countries seem to go through nasty phases. Within the lifetime of most people today, we’ve seen it in big countries such as Russia, Germany, and China. And in scores of smaller ones – the list is too long to recount here. The good news is that things almost always get better, eventually.

Editor’s Note: As these trends continue to accelerate, what you do right now can mean the difference between coming out ahead or suffering crippling losses.

That’s exactly why bestselling author Doug Casey and his team just released a free report with all the details on how to survive an economic collapse.

It will help you understand what is unfolding right before our eyes and what you should do so you don’t get caught in the crosshairs.

Click here to download the PDF now.

Be seeing you

Posted in Uncategorized | Tagged: capital accumulation, debt, Fascism, inflation, TECHNOLOGY | Leave a Comment »

Posted by M. C. on January 25, 2020

Easy Fed fake money has lenders in a bind.

https://www.cnbc.com/2020/01/23/fico-10-credit-score-changes.html

Americans who are struggling to pay off their debt could see lower FICO credit scores in their future, especially if they miss payments.

Fair Isaac Corp., the company behind the popular FICO credit score, announced the launch of its latest FICO 10 model today, Jan. 23, that will start incorporating consumers’ debt levels into their scoring model.

This comes as total household debt in the U.S. has steadily increased for about two years, and currently sits at about $13.95 trillion as of last September 2019, according to the Federal Reserve Bank of New York. That’s higher than the previous high of $12.68 trillion seen right before the 2008 financial crisis.

“This was bound to happen,” John Ulzheimer, an expert on credit scores and credit scoring, tells CNBC Make It. “The job of scoring models is to properly assess risk, not simply give people better scores as a default position.”

FICO estimates that about 110 million consumers will see a change of less than 20 points to their score under the new credit score model. Overall, roughly 80 million consumers will see a change in score of 20 or more points in either direction, upward or downward, FICO says.

Those who fall behind on their loan payments are more likely see the drop in their score, according to the Wall Street Journal, who first reported the changes. FICO also plans to flag consumers who sign up for personal loans, which are generally considered more risky since these are unsecured and typically do not require collateral like a car or a house.

“Those consumers with recent delinquency or high utilization are likely going to see a downward shift and depending on the severity and recency of the delinquency it could be significant,” Dave Shellenberger, FICO vice president of product management, said in a statement.

The new scoring model will also likely create a wider gap between those who are considered good credit risks and those who are not. Consumers who already have good credit, for example, and who continue to whittle down their already existing loans and make on-time payments will see higher scores. But those who score below 600 will see bigger dips in their scores under the new model.

This is a shift from many of the consumer-friendly policies that have popped up in recent years aimed at bolstering credit scores and building scores for those with little to no credit history by adding in payment history and account information.

“We’ve unfortunately found ourselves in an era where it’s becoming commonplace to water down the breadth of information on credit reports,” Ulzheimer says, adding that tax liens, judgments, medical collections and medical debt have all been removed or delayed from some credit scoring models.

“All of this is great for consumers who have tax liens, judgments, and medical collections…but it’s not great for scoring models and their users,” Ulzheimer adds. But he notes the new scoring model is not “consumer unfriendly” either. “People with good credit are going to score higher with newer models. People who have elevated risk are going to score lower.”

Despite the changes, it may take a while for consumers to notice the new changes. That’s because “change comes slowly in credit monitoring,” says CreditCards.com’s industry analyst Ted Rossman.

It’s up to banks and lenders decide which model they will use. The latest FICO scoring model in use is FICO 9, which was released in August 2014, although many lenders still use older models, such as FICO 8 model that came out in 2009. Meanwhile other lenders prefer to use VantageScore, which is produced by the credit bureaus Experian, Equifax and TransUnion.

“Rather than getting too hung up on which model a particular lender is using, consumers should practice fundamental good habits such as paying their bills on time and keeping their debts low,” Rossman says.

Be seeing you

Posted in Uncategorized | Tagged: Credit Score, debt, Fed, FICO 10 | Leave a Comment »

Posted by M. C. on May 18, 2016

Here is a question posed by a friend. My response follows.

The Fed has caused the dollar to be worth 1% of what it was worth in 1913. Its main purpose is to bail out banks, fund wall street big shots and pay for war. It ain’t about us little guys.

Passing thoughts as I read.

I will be kind to Ellen Brown and say Libertarian economists have little regard for her economic chops. That said Ellen’s final paragraph is a pleasant surprise.

Ben Franklin was a statist and had the government money printing contract. According to Murray Rothbard in “Conceived in Liberty” the “Continental” became so worthless soldiers eventually did not bother to collect their pay.

Lincoln’s greenbacks killed 600-700,000 so Northern industry could keep taking advantage of the cheap Southern labor. Machine gun disguised as printing press. Most countries that ended slavery managed to do it without killing off a generation. “Robust national growth” consisted to a great degree of crony capitalist (Lincoln railroad buddies) endeavors helped along by fake money and stealing land.

Low inflation is due to banks holding on to a lot of the counterfeit money as the article states. Businesses are propping up the market to a degree by buying back their stock, not by being productive. My understanding is the Dow has only a dozen or so big players propping the numbers up. If all the extra cash were let loose at once I think there would be people with wheelbarrows in breadlines.

Anyone going to the grocery store or buying clothes knows inflation numbers are fake. “Corrections” for farm prices, energy or weather paper over what us rubes have to deal with in real life.

Helicopter money leads to bridges to nowhere, backing badly run solar panel companies, Chevy Volts and Chinese towns that are empty with nearby airports with no planes and “tallest buildings” with no tenants. No shortage of poverty, ignorance or disease though. This is another way of saying central planning government is incapable of properly directing resources. That is what they free market is for.

“Free money” always has government strings attached. Just like when Edinboro accepts government money but has to teach the way the government directs. As you may know the strings are what fouls things up. Remember when W gave us all rebates to stimulate and a large chunk went to paying off credit card debt instead? Best laid plans…

Agree. Fractional reserve banking is like printing money. Lending legal money they don’t have. So when people get scared and go to retrieve their money there is none to be had. Fractional reserve banking should be as illegal. It is fraud.

Ron Paul indeed says to renege on the debt. I don’t understand the legalities/ramifications but I feel certain it is impossible to repay debt without printing massive amounts of money. I read where current unfunded government liabilities of all kinds is roughly $200T. There will be economic collapse well before the printer covers that.

It sounds like The Donald accidentally spoke the truth about paybacks then later “clarified”. Restructuring our debt ala chapter 11 seems the only reasonable solution. Just like in real, beyond the beltway life. Who really knows what The Donald thinks about printing money? He is nuts if he thinks it is a viable solution to our woes. But no worse than the Keynesians running our show.

If printing money is so benign why not fund the government entirely with a printing press? Why not just pay everybody a guaranteed income by printing? That is what The Bern wants to do. It is welfare on a massive scale. The potential doctor who could be treating a cancer instead sits around waiting for the government check just as he was indoctrinated.

Argentina, Venezuela, China, Japan, the EU and the US are all printing money and choking on it. The printing press got the world in the mess it is in and the government solution is more of the same. How can it get any plainer?

The Fed is the proverbial free lunch. No such thing.

Who really knows what The Donald thinks about printing money? He may be nuts but no worse than the Keynesians running the show.

Be seeing you

![]()

Posted in Uncategorized | Tagged: debt, Ellen Brown, Fed, Keynes, recovery, Trump | Leave a Comment »

Posted by M. C. on April 19, 2014

There is change in the air. You can feel it.

When I first heard of China buying our debt I thought-This isn’t supposed to be happening. This is America. What have they got that we don’t?

Cash. China has lots of cash to spend because they print it like US. That is why they are in a manufacturing bubble. Their bubble like ours will certainly burst. But when and how will they react?

The debt buying is an indicator of a power shift. A drop for the US more than a rise in China.

http://bionicmosquito.blogspot.com/2014/03/ukraine-and-shifting-orbits.html

I agree with the opinion that the economic and political power of the West, the US in particular, is shrinking. The failed drug war, the holes in the Middle East which we are digging deeper, finding terrorists under every rock, lately African rocks and other feeble attempts to grab power. Too many failures. Too much scrambling. The US is looking desperate. We are a mess. Read the rest of this entry »

Posted in Uncategorized | Tagged: China, debt, EU, Germany, manufacturing bubble | Leave a Comment »