By Tyler Durden

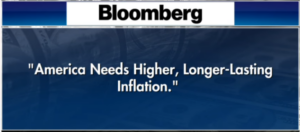

Biden’s “Build Back Better” efforts have been a phenomenal failure so far, but maybe that’s because Americans just don’t understand a good thing when they see it?

This has been Biden’s argument on the state of the economy lately, as he persistently argues that there is no threat of recession because the US jobs market still “strong.” There is no mention from the White House regarding the fact that covid stimulus spending artificially drove up retail demand and created a temporary spike in jobs. If they were to admit that layoffs are about to ramp up because the covid checks are gone and people’s credit cards are maxed out because of inflation, then Biden would have nothing left to brag about.

Biden economic adviser Cecilia Rouse responded to media question on the inflation situation in particular this week and offered even more propaganda, rather than an honest assessment of the dangers ahead. Remember, this is the same administration that was still saying only a year ago that inflation was “transitory” despite all evidence to the contrary. Yet, we’re now supposed to trust their opinions on the potential for recession and solving inflation?

One of the key obstacles to “Build Back Better” is the reality of high inflation. If Biden gets what he wants, which is at bottom an infrastructure renewal plan similar to the New Deal plan under FDR during the Great Depression. Whether or not the New Deal actually saved the US economy is up for debate (the destruction caused by WWII left the US as one of the only major manufacturing nations still intact, and this was the main reason for the explosion in wealth and the national escape from poverty), but even if it made a difference the circumstances today are not the same.

The problem is that FDR was facing a deflationary crash in which the US dollar remained viable and strong. Today, we are dealing with a stagflationary crash in which price inflation is rampant and the dollar’s buying power is growing ever weaker. One of the main reasons for this inflation is due to government spending and massive Federal Reserve stimulus created from thin air.

Be seeing you